Mortgage Equity Calculator

Calculate your home equity and loan-to-value ratio to understand your ownership stake while you have a mortgage.

When you hear the word homeowner, you probably picture someone who fully owns their house, right? But what if there’s a mortgage hanging over the property? Do you still count as a homeowner, or does the loan turn you into a borrower first? Let’s break it down, clear up the confusion, and give you a roadmap for keeping your ownership rights solid while you’ve got a mortgage.

What a Homeowner is a person who holds legal title to a residential property, regardless of financing arrangements really means

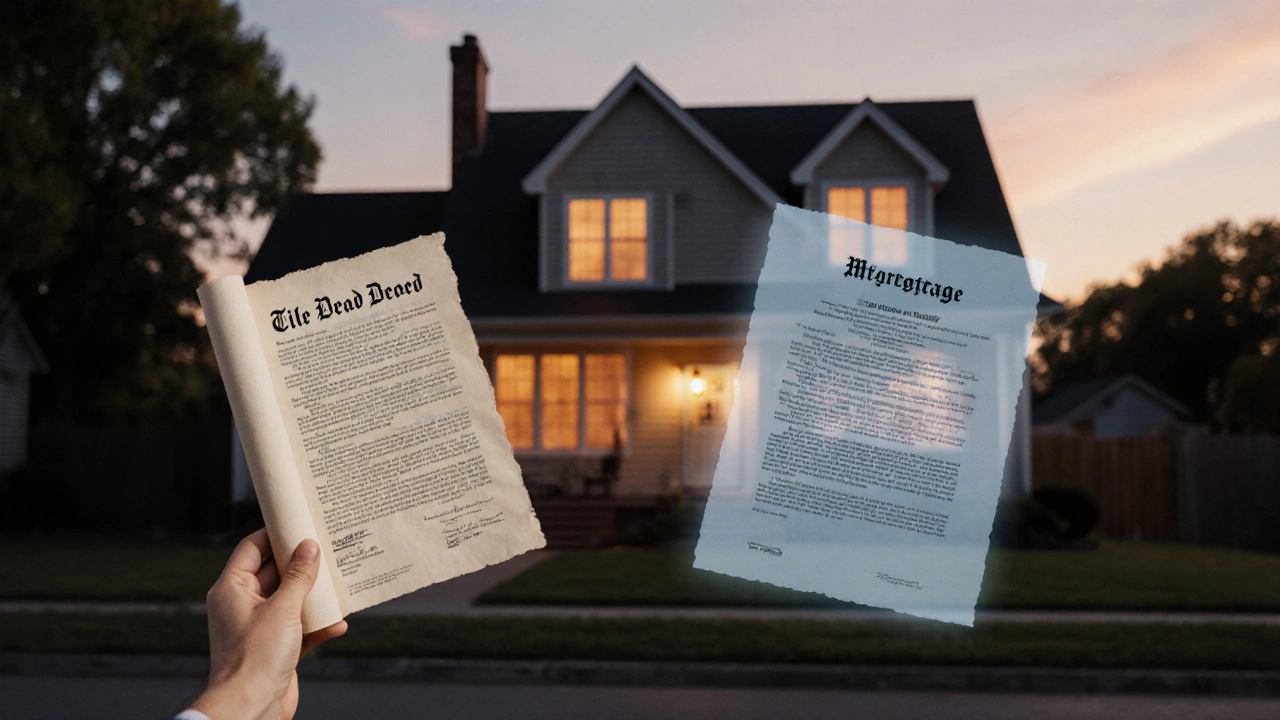

In everyday language, a homeowner is anyone whose name appears on the title deed. The title deed is the official document that proves you own the land and any structures on it. Whether you bought the house outright with cash or financed it through a bank, the name on that deed makes you the legal owner.

How a Mortgage is a loan secured against real estate, giving the lender a charge over the property until the debt is repaid changes the picture

A mortgage is essentially a loan that uses the property as collateral. When the lender (the bank or credit union) grants you the loan, they place a charge on the title deed. That charge means the lender has a legal interest in the property until you clear the debt. It doesn’t erase your name from the deed; it just adds an extra layer of rights for the lender.

Key Rights and Responsibilities When You Have a Mortgage

- Title Deed is the legal document that proves ownership of a property still lists you as the owner.

- Land Registry records all interests and charges on a property, including mortgages holds the lender’s charge alongside your ownership.

- You must keep up with mortgage repayments; missing payments can trigger Foreclosure the legal process where a lender takes possession of a property due to default.

- You can still sell or refinance the property, but you’ll need the lender’s consent because the charge must be cleared or transferred.

- While the loan is active, you build Equity the portion of the property’s value that you truly own, calculated as market value minus loan balance as you pay down the principal.

Step‑by‑Step Guide: Registering a Property When You Have a Mortgage

- Obtain a Title Deed from the seller or previous owner.

- Engage a qualified Conveyancer is a legal professional who handles the transfer of property ownership to review the deed and the mortgage documents.

- The lender will provide a Mortgage Agreement details the loan amount, interest rate, and the lender’s charge on the property.

- The conveyancer lodges both the deed and the lender’s charge with the Land Registry. This creates an official record that you own the property, but the lender also has a secured interest.

- Pay the required stamp duty and registration fees. In Victoria, for example, stamp duty thresholds differ for owner‑occupied homes versus investment properties.

- Receive the registered title. It will list you as the proprietor and the lender as a charge holder.

Common Misconceptions About Homeownership and Mortgages

- "If I have a mortgage, I’m not a real homeowner." - Wrong. You own the title; the mortgage just adds a financial encumbrance.

- "I can’t sell my house until the mortgage is paid off." - Not true. You can sell, but the sale proceeds must first clear the lender’s charge.

- "The lender can walk into my house anytime." - Incorrect. The lender’s rights are limited to legal actions like foreclosure after default; they cannot simply enter the property.

Comparison: Ownership Rights With vs. Without a Mortgage

| Aspect | With Mortgage | Without Mortgage |

|---|---|---|

| Title Deed Owner | Your name plus lender’s charge | Your name only |

| Equity Building | Gradual as you repay principal | Immediate full equity |

| Sale Process | Must settle mortgage first | Simple transfer |

| Risk of Loss | Foreclosure if you default | Only market risk |

| Tax Implications | Interest may be deductible (if investment) | No mortgage interest deduction |

Practical Tips to Protect Your Ownership While Under Mortgage

- Keep a backup of all loan documents, title deed, and registration records. Digital copies stored securely help if the original paper gets lost.

- Maintain a good Credit Score a numerical representation of your creditworthiness. A solid score can help you refinance at better rates, increasing equity faster.

- Set up automatic payments to avoid accidental defaults that could trigger foreclosure.

- Monitor the Loan‑to‑Value Ratio the proportion of the loan amount to the property’s market value. Keeping this ratio under 80% often gives you more flexibility.

- When you’re ready to move, request a Settlement Statement breaks down the financial details of a property transaction. It shows exactly how much will go to the lender, taxes, and any other fees.

Frequently Asked Questions

Does a mortgage erase my ownership rights?

No. Your name stays on the title deed, but the lender’s charge is recorded alongside it. You still have the legal right to occupy and sell the property, subject to the loan’s terms.

Can I refinance before the mortgage is fully paid?

Yes. Refinancing means replacing the existing loan with a new one, often at a better rate. The new lender will take over the charge on the title deed.

What happens to my equity if I sell the house?

The sale price first pays off the remaining mortgage balance. Whatever is left goes to you as equity. If the sale price is lower than the loan, you may need to cover the shortfall.

Is it possible to own a property without any mortgage in Australia?

Absolutely. Buying with cash means the title deed lists only your name, with no charge. This gives you full control and eliminates interest costs.

Do I need a lawyer to register a property with a mortgage?

A licensed conveyancer or solicitor is strongly recommended. They ensure the mortgage charge is correctly lodged and that all paperwork complies with state regulations.

Bottom line: having a mortgage doesn’t strip you of homeowner status. It adds a financial obligation that shows up in the land registry, but your name on the title deed still makes you the legal owner. Keep up with repayments, stay on top of registration details, and you’ll protect both your roof and your rights.