Virginia 3-Bedroom Housing Voucher Calculator

Calculate Your Housing Voucher Costs

Note: This calculation shows the maximum rent you can afford within your voucher payment standard. If you find a unit above this amount, you'll need to cover the difference yourself.

If you're looking for a 3-bedroom home in Virginia and you're relying on a housing voucher, you're probably wondering: how much will the voucher actually cover? The answer isn’t simple-it changes based on where you live, your income, and what the local housing market is doing right now.

Virginia’s Housing Voucher Program Is Local

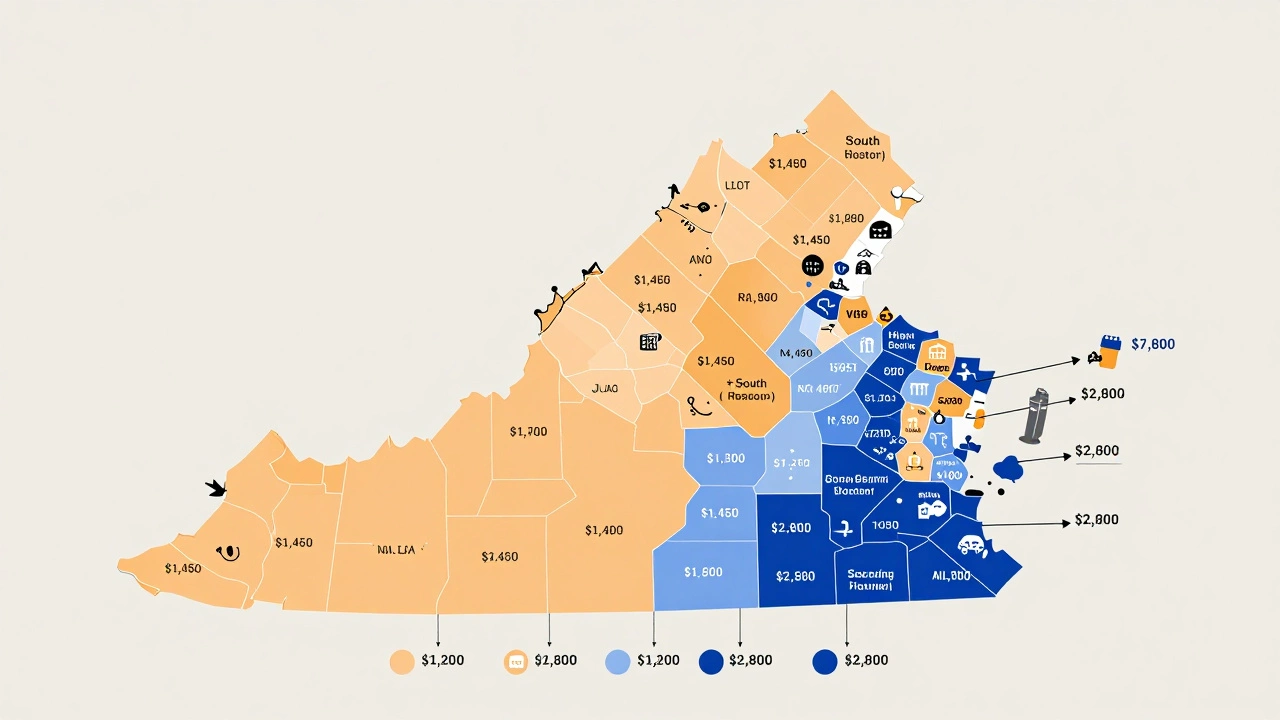

Virginia doesn’t have one single voucher amount for a 3-bedroom apartment. The program is run by local Public Housing Agencies (PHAs), and each one sets its own payment standards. That means a voucher in Richmond might pay $1,800 toward rent, while one in Fairfax County could pay $2,600-even if both are for the same size unit.The federal government, through HUD, gives each PHA a Fair Market Rent (FMR) number every year. This is based on what most people in that area pay for similar homes. For 2025, the FMR for a 3-bedroom in Virginia ranges from $1,450 in rural areas like South Boston to over $2,800 in Arlington or Alexandria.

What You Actually Get Depends on Your Income

The voucher doesn’t pay the full rent. You pay 30% of your monthly adjusted income toward rent. The voucher covers the rest-up to the local payment standard. So if your income is $2,000 a month, you pay $600. If the rent is $2,000 and the voucher pays up to $2,200, then the voucher covers $1,400.But here’s the catch: if the rent is higher than the payment standard, you have to pay the difference. For example, if the payment standard is $2,100 but you find a 3-bedroom for $2,500, you’ll need to pay $900 total: $600 (your 30%) plus $300 extra. Many landlords won’t accept vouchers if the rent is above the standard because they know you can’t afford it.

Where You Live Makes the Biggest Difference

Here’s what 3-bedroom voucher payment standards look like in key Virginia areas as of 2025:| City/County | Payment Standard (Monthly) | Fair Market Rent (FMR) |

|---|---|---|

| Arlington | $2,800 | $2,750 |

| Alexandria | $2,650 | $2,600 |

| Fairfax County | $2,550 | $2,500 |

| Richmond | $1,900 | $1,850 |

| Virginia Beach | $2,100 | $2,050 |

| Roanoke | $1,700 | $1,680 |

| South Boston | $1,450 | $1,420 |

These numbers are what the voucher can pay toward rent. They don’t include utilities unless the PHA includes them in the standard. Some agencies add $100-$200 for heat, electricity, or water-others don’t. Always ask your local housing office what’s included.

Wait Lists Are Long-Sometimes Years

Getting a voucher isn’t just about the amount. You have to get on a waitlist first. In most Virginia counties, the wait for a 3-bedroom voucher is 18 to 36 months. Some places, like Fairfax County, close their waitlists for years at a time because demand is so high.If you’re on a waitlist, you’ll get a letter when your name comes up. But even then, you still need to find a landlord who accepts vouchers. Many private landlords don’t want to deal with the paperwork, inspections, or delayed payments. That’s why many voucher holders end up stuck in smaller units or less desirable neighborhoods.

What You Can Do Right Now

If you need help now, don’t wait for a voucher to open up. Here’s what actually works:- Check your local PHA website-every county has one. Look for “Housing Choice Voucher Program” or “Section 8.”

- Call the office-waitlists change. Ask if they’re accepting applications, and if they have a preference list (for veterans, disabled, or homeless families).

- Apply to multiple PHAs-if you’re close to a border, apply in neighboring counties. A voucher from Prince William County might be easier to get than one from Alexandria.

- Look for “tenant-based” vouchers-these let you move with the voucher. “project-based” vouchers are tied to one building and won’t help if you need to relocate.

- Ask about emergency vouchers-some PHAs have small funds for families facing eviction or domestic violence.

Why Some People Get More Than Others

Not everyone gets the same voucher amount-even in the same city. Why? Because the voucher is adjusted for family size, income, and deductions. If you have a child with a disability, you might get a higher payment standard. If you pay for childcare, that can lower your income calculation, which increases your voucher amount.Some PHAs also give priority to people who are homeless, living in unsafe housing, or paying more than half their income on rent. If you’re in that situation, make sure you tell the housing office and ask for documentation.

What Happens If You Find a Place Above the Standard?

You can rent a place that costs more than the payment standard-but you’ll pay the difference. Most people can’t afford that. But if you have a little extra income-say, from a part-time job or child support-you might be able to stretch it.Some PHAs allow you to use “bonus payments” if you’re moving to a high-opportunity area. For example, if you’re moving from a high-poverty neighborhood to a safer school district, your voucher might be increased by up to 10%. Ask your caseworker if this applies to you.

Common Mistakes to Avoid

People lose vouchers all the time because of small mistakes:- Not reporting a raise or new income-this can lead to overpayment and repayment demands.

- Signing a lease before the voucher is approved-landlords can cancel if the voucher doesn’t come through.

- Choosing a unit that hasn’t passed inspection-your PHA will not pay for unsafe or unsanitary housing.

- Forgetting to renew your recertification-miss the deadline, and your voucher gets cut off.

Always keep copies of every form, every letter, and every email. If something goes wrong, you need proof.

What If You’re Denied?

If you’re denied a voucher or your application is put on hold, you have the right to appeal. Each PHA has a formal appeals process. You can bring someone with you-a family member, a legal aid lawyer, or a housing advocate. Many nonprofits in Virginia offer free help with appeals. Search for “Virginia housing legal aid” or contact the Virginia Poverty Law Center.Next Steps

If you’re serious about getting a 3-bedroom voucher in Virginia:- Go to your local PHA’s website today.

- Find out if the waitlist is open.

- Apply even if it looks full-sometimes spots open unexpectedly.

- Start looking at rental listings that say “Section 8 accepted.”

- Call your local housing authority and ask for a copy of their payment standard chart.

There’s no magic number. But knowing the system, knowing your rights, and staying organized gives you the best shot. A 3-bedroom voucher isn’t guaranteed-but it’s not impossible either.

How much does a 3-bedroom Section 8 voucher pay in Virginia?

It depends on your location. Payment standards range from $1,450 in rural areas like South Boston to $2,800 in Arlington. The voucher covers rent above what you pay (30% of your income), up to the local limit.

Can I use a housing voucher anywhere in Virginia?

Yes, if you have a tenant-based voucher. You can move to any area where the voucher is accepted, as long as the rent is within the payment standard of your new location. You’ll need to notify your PHA before moving.

Why are waitlists so long for housing vouchers in Virginia?

There are far more eligible families than vouchers available. Federal funding hasn’t kept up with demand. In some counties, waitlists are closed for years because they have over 10,000 names on them.

Do I need to be a U.S. citizen to get a housing voucher in Virginia?

No. You must be a U.S. citizen or have eligible immigration status. Many legal permanent residents, refugees, and asylees qualify. Your household’s immigration status is reviewed during application.

Can I get a 3-bedroom voucher if I’m single?

Yes, if you qualify based on income and family size. A single person can request a 3-bedroom if they have a child with a disability, a live-in aide, or other approved reasons. PHAs review each request individually.

What if my voucher runs out before I find a place?

You usually have 60 to 120 days to find housing after receiving your voucher. If you need more time, you can request an extension from your PHA-especially if you’ve been actively searching. Don’t wait until the last minute to ask.

Are utility costs included in the voucher amount?

Sometimes. Some PHAs include a utility allowance in the payment standard-others don’t. Ask your housing office what utilities are covered and how much they estimate you’ll pay each month.

Can I get a voucher if I have bad credit?

Yes. Your credit score doesn’t disqualify you. Landlords can still reject you based on rental history, but the voucher program only checks income and immigration status. You’ll need to pass a background check for criminal history, but not for credit.