NYC Property Registration Fee Calculator

Calculate Your Fees

Note: This calculator shows both the NYC registration fee and New York State transfer tax. Both fees must be paid separately. The NYC fee is $125 for properties under $500,000 and $250 for properties over $500,000. State tax is 0.4% for properties under $500,000 and 0.65% for properties over $500,000.

Buying a home in New York City isn’t just about signing papers and getting the keys. Before you can even think about moving in, you have to officially register your property with the city. That means paying a registration fee-and if you get it wrong, you could face delays, fines, or even lose your claim to the property. The process isn’t complicated, but it’s easy to mess up if you don’t know where to start.

What Exactly Is the Property Registration Fee?

The property registration fee in NYC is a mandatory charge you pay when you record a deed with the New York City Register’s Office. This isn’t a tax-it’s a fee to officially document the change in ownership. Every time a property changes hands, whether it’s a house, condo, or co-op, the new owner must file the deed and pay the fee. The amount depends on the property’s sale price and location.

For residential properties, the fee is $125 for properties under $500,000. If the sale price is $500,000 or more, the fee jumps to $250. These rates apply to Manhattan, Brooklyn, Queens, Staten Island, and the Bronx. There’s also a separate fee for the New York State Real Property Transfer Tax, which is usually 0.4% for sales under $500,000 and 0.65% for sales above that. That’s on top of the city’s registration fee.

Who Pays the Fee?

In most cases, the buyer pays the property registration fee. But it’s not set in stone. In competitive markets, sellers sometimes agree to cover it as part of the deal. Check your contract. If it doesn’t say who pays, assume it’s your responsibility. Not paying on time can delay your title insurance, lock you out of refinancing, or even trigger penalties from the city.

How to Pay the Fee: Step-by-Step

Here’s how to pay your NYC property registration fee without headaches:

- Get your deed ready. Your attorney or title company will prepare the deed. Make sure it’s signed by both buyer and seller, notarized, and includes the full legal description of the property.

- Calculate the fee. Use the NYC Department of Finance’s online calculator or multiply the sale price by the rate. For example, a $750,000 condo means a $250 registration fee plus $4,875 in state transfer tax.

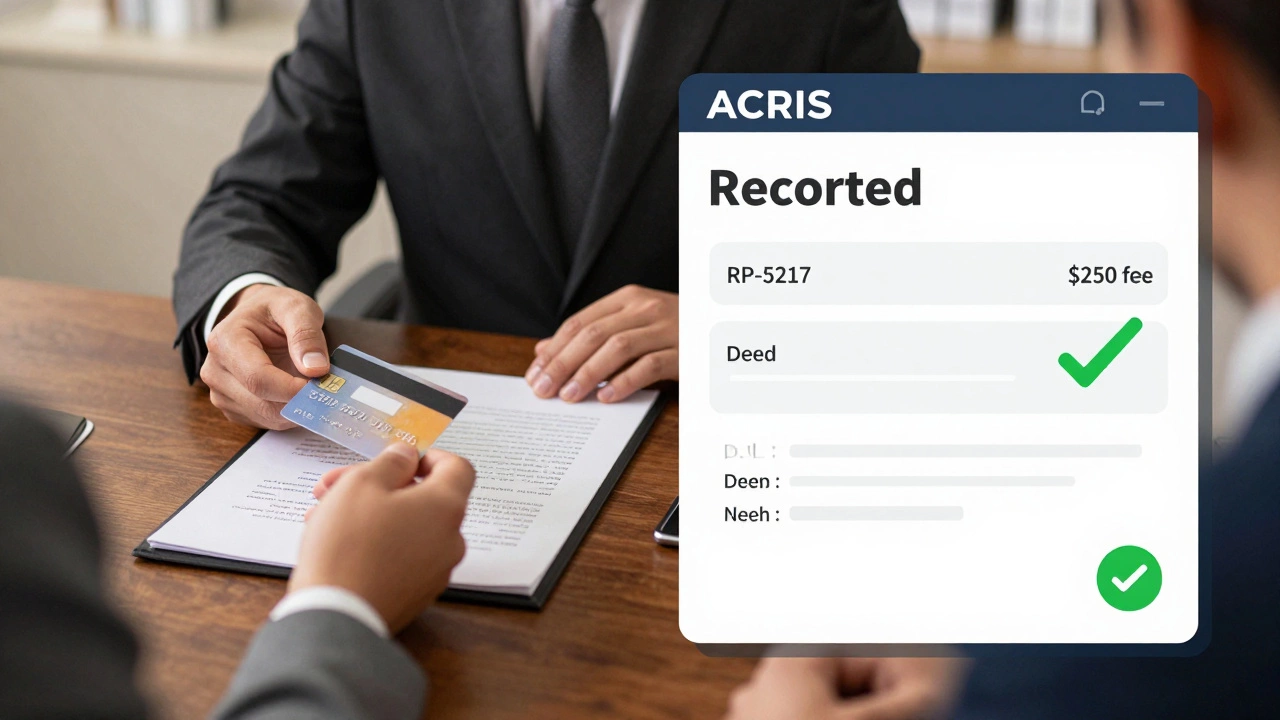

- Fill out Form RP-5217. This is the Real Property Transfer Tax Return. You’ll need the sale price, property address, buyer and seller names, and the attorney’s information. Your lawyer usually handles this, but you should review it.

- Pay online or in person. The easiest way is through the NYC Department of Finance’s ACRIS system. You can pay with a credit card (Visa, Mastercard, Discover), debit card, or electronic check. If you’re not comfortable doing it yourself, your title company or attorney can file and pay for you-just make sure they confirm payment before closing.

- Keep your receipt. After payment, you’ll get a confirmation number and a stamped copy of the deed. Save this. You’ll need it if you ever sell the property or apply for a home equity loan.

What Happens If You Don’t Pay?

Skipping the fee sounds like a way to save money-but it’s a trap. The city won’t recognize your ownership until the deed is recorded. That means:

- You can’t get title insurance

- You can’t refinance or take out a home equity line

- You might not be able to prove you own the property if there’s a dispute

- You could be charged late fees of $50 per month until it’s resolved

- The previous owner’s name might still show up on tax bills

In extreme cases, the city can place a lien on the property. That’s not something you want to fix after you’ve moved in.

Common Mistakes People Make

Even experienced buyers mess this up. Here are the top three errors:

- Confusing the city fee with the state tax. The $250 registration fee is separate from the state’s transfer tax. Both must be paid. Many people pay one and forget the other.

- Using cash or personal check. The NYC Register’s Office doesn’t accept cash or personal checks. Only credit/debit cards or electronic bank transfers work.

- Waiting until the last minute. Recording can take 3-5 business days. If you wait until closing day, you risk delays. Start the process at least a week before your closing date.

Can You Pay Without a Lawyer?

You don’t legally need a lawyer to pay the fee-but it’s risky. The paperwork is technical. A single typo in the property address or wrong parcel number can cause the filing to be rejected. Most buyers use a title company or attorney because they handle the whole process: preparing documents, calculating fees, submitting them, and confirming receipt. If you’re buying a simple condo in a building with clear records, you *might* do it yourself. But for co-ops, townhouses, or properties with complex histories, hire a pro.

What About Co-ops and Condos?

Co-ops are different. You’re not buying real estate-you’re buying shares in a corporation that owns the building. So you don’t record a deed. Instead, you file a stock transfer and proprietary lease with the co-op board. The fee is usually handled by the building’s managing agent and is much lower-often around $100. But you still need to pay it.

Condos are treated like traditional real estate. You get a deed, you record it, you pay the $125 or $250 fee. Make sure you know which type of property you’re buying before you start the process.

Where to Find Help

If you’re stuck, here are the official resources:

- ACRIS Online - The city’s official property records portal. You can search past transactions and pay fees here.

- NYC Department of Finance - Deed Recording Fees - Up-to-date fee schedules and forms.

- NYC Real Property Transfer Tax - Details on state tax rates and exemptions.

Also, your title company should give you a checklist. If they don’t, ask for one. A good title company will walk you through every step-no extra charge.

How Long Does It Take to Get Confirmation?

After you pay online, you’ll get an immediate confirmation email. The actual recorded deed usually shows up in the ACRIS system within 3 to 5 business days. You can check your property’s status anytime by searching the address on ACRIS. Look for the deed under "Instrument Type: DEED" and confirm the recording date matches your payment date.

If it’s been over a week and you don’t see it, call the NYC Register’s Office at (212) 445-0682. Have your confirmation number ready.

What If You’re Buying from an Estate or Foreclosure?

Special rules apply. If the property was inherited, you might qualify for a partial exemption from the state transfer tax-but you still pay the city’s registration fee. Foreclosures can be messy. Sometimes the bank hasn’t paid old fees, and those can become your responsibility. Always run a title search before closing. A title company can flag issues before you pay anything.

Final Tip: Don’t Skip the Receipt

After you pay, print or save the confirmation page. Take a screenshot. Email it to yourself. Keep it with your closing documents. Ten years from now, when you sell, you’ll need to prove you paid the original registration fee. Without it, you could face questions from the buyer’s attorney or the city. It’s a small step now that saves hours later.

Do I have to pay the property registration fee if I inherit a property in NYC?

Yes, you still pay the $125 or $250 registration fee to record the deed. But you may qualify for an exemption from the New York State Real Property Transfer Tax if the property was inherited from a family member. You’ll need to file Form TP-584 with proof of inheritance to claim the exemption.

Can I pay the fee with a personal check?

No. The NYC Register’s Office only accepts payments by credit card, debit card, or electronic bank transfer through the ACRIS system. Personal checks and cash are not accepted. If you try to mail a check, it will be returned and your filing delayed.

What if I make a mistake on the deed?

If you catch the error before filing, fix it with your attorney. If the deed is already recorded with a mistake-like the wrong address or misspelled name-you’ll need to file a corrective deed. That requires paying another registration fee. Always double-check all names, addresses, and parcel numbers before submitting.

Is the property registration fee refundable if the sale falls through?

No. Once you pay and the deed is filed, the fee is non-refundable-even if the sale doesn’t close. That’s why it’s smart to wait until all contingencies are cleared before paying. Most buyers pay the fee only after inspections and financing are approved.

Do I need to pay this fee every year?

No. The property registration fee is a one-time charge paid only when ownership changes. You pay it once when you buy the property. After that, you’ll pay property taxes annually, but that’s a separate bill from the registration fee.