Living Wage Calculator

Your Income

Results

Enter your income and location to see if you can cover basic expenses.

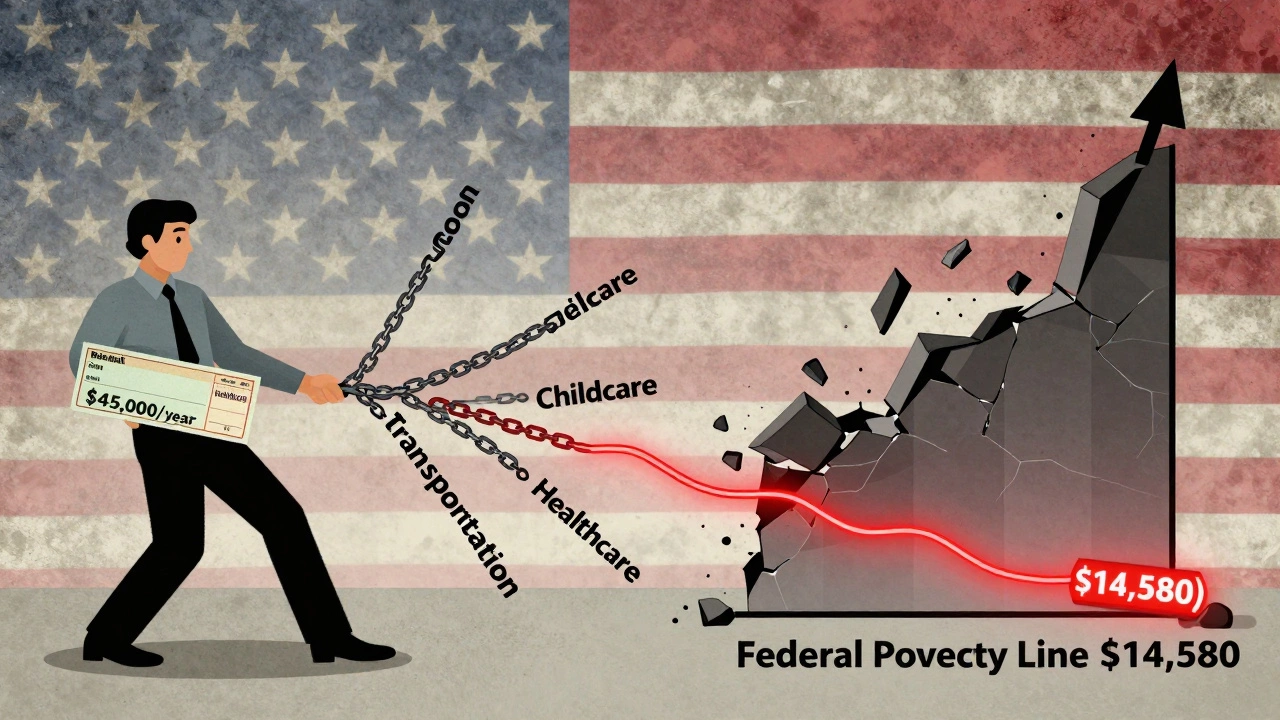

Can you survive on $45,000 a year in 2026? For many Americans, the answer isn’t yes-it’s barely. This isn’t about luxury. It’s about keeping the lights on, paying rent, eating food that isn’t canned, and not choosing between medicine and groceries. The official poverty line for a single person in 2026 is $14,580. But that number is a relic. It was designed in the 1960s based on food costs alone. Today, housing eats up half your paycheck before you even think about utilities, transportation, or childcare.

Housing Costs Are the Real Poverty Line

If you make $45,000 a year, that’s $3,750 a month before taxes. After federal and state taxes, you’re looking at roughly $3,000 take-home pay. Now, try to find a one-bedroom apartment anywhere in the U.S. for less than $1,200. In 2026, that’s only possible in rural areas or cities with strict rent control. In most metro areas-like Atlanta, Phoenix, or even smaller towns near big cities-you’re looking at $1,500 to $2,200 a month for a basic unit. That’s 50% to 70% of your income going to rent alone.

The Department of Housing and Urban Development (HUD) defines housing as affordable if it costs no more than 30% of your income. At $45,000, that means $900 a month for rent. But in 92% of U.S. counties, a full-time minimum wage worker can’t afford a two-bedroom apartment at that rate. At $45k, you’re barely above minimum wage. You’re not poor by the government’s old math-but you’re living paycheck to paycheck with zero buffer.

What $45k Actually Buys in 2026

Let’s break it down for someone living alone in a mid-sized city like Columbus, Ohio, where rents are lower than in New York or San Francisco but still rising.

- Rent: $1,400 (one-bedroom apartment)

- Utilities (electric, water, gas, internet): $180

- Transportation (car payment, gas, insurance): $400

- Food: $400 (groceries only, no dining out)

- Health insurance (ACA plan with subsidy): $250

- Phone and miscellaneous: $100

- Emergency fund contribution (what’s left): $120

That’s $2,750 spent. You have $250 left. That’s not savings. That’s for a flat tire, a broken phone, or a doctor’s copay. One unexpected expense-say, a $500 dental bill-and you’re using a credit card. Then you’re paying 20% interest. That’s how people get trapped.

Now imagine you have a child. Add childcare. In Ohio, average infant care costs $1,100 a month. That’s more than your rent. Suddenly, $45k doesn’t just feel tight-it’s impossible. You’d need to work 60 hours a week just to cover the basics. And that’s if you can even find childcare that accepts your income level.

The Myth of the “Working Poor”

People say, “If you work hard, you can get by.” But hard work doesn’t raise rents. It doesn’t fix broken public transit. It doesn’t magically make healthcare cheaper. The U.S. has 7.5 million full-time workers earning under $30,000 a year. Another 12 million earn between $30k and $45k. These aren’t lazy people. They’re nurses’ aides, warehouse workers, teachers’ assistants, grocery clerks, and home health aides. They show up every day. But their paychecks don’t match the cost of living.

A 2025 study by MIT’s Living Wage Calculator found that a single adult needs $18.50 an hour to cover basic needs in most parts of the country. That’s $38,500 a year. For a single parent with one child? $51,000. So $45k puts you above the bare minimum-but still below what’s actually needed to live without constant stress. You’re not poor. You’re just not free.

Why the Official Poverty Line Doesn’t Matter Anymore

The federal poverty line hasn’t changed its formula since 1969. It’s based on the cost of food multiplied by three. Back then, families spent about a third of their income on food. Now? We spend less than 10%. Housing, healthcare, and childcare are the real expenses. The government still uses this outdated number to determine eligibility for food stamps, Medicaid, and housing vouchers. That means someone making $45k doesn’t qualify for any assistance-even if they’re skipping meals to pay rent.

Some states, like California and New York, use their own “self-sufficiency standards” that reflect local costs. In San Francisco, $45k would put you in deep poverty. In rural Mississippi, you might manage. But there’s no national standard that matches reality. The gap between what the government says is poor and what people actually need to survive keeps growing.

What Can You Do If You’re Making $45k?

There’s no magic fix. But here’s what works for people who are trying:

- Find a roommate. Even splitting a two-bedroom apartment can cut rent in half.

- Apply for housing vouchers. Waitlists are long, but they exist. Start now.

- Use SNAP (food stamps). If you qualify, it’s not charity-it’s a benefit you paid for through taxes.

- Check for local nonprofits. Many offer emergency rent assistance, free tax prep, or discounted childcare.

- Work with a housing counselor. Nonprofit agencies can help you negotiate with landlords or find subsidized units.

And if you’re in a position to advocate-vote. Push for local rent control, more public housing, and living wage laws. $45k isn’t enough because the system is broken, not because you’re not trying hard enough.

The Bigger Picture: Housing Is a Human Right

Other wealthy countries don’t make their workers choose between rent and insulin. In Germany, rent is capped at 30% of income in most cities. In Canada, housing is part of the national health strategy. In Japan, landlords can’t raise rent without approval. The U.S. treats housing like a commodity-not a need.

When you make $45k and still can’t afford a safe place to sleep, it’s not a personal failure. It’s a policy failure. The numbers don’t lie: the cost of housing has risen 87% since 2000, while wages have only gone up 21%. That’s not inflation. That’s exploitation.

If you’re making $45k a year and still struggling, you’re not alone. You’re part of a growing majority. And you deserve more than a poverty line that ignores reality.

Is $45,000 a year considered poverty in the U.S.?

By the federal government’s outdated poverty line, no-$45,000 is well above the $14,580 threshold for a single person. But in reality, that number doesn’t reflect today’s costs. At $45k, most people can’t afford rent, food, healthcare, and transportation without constant financial stress. You’re not officially poor, but you’re living in economic precarity.

Can you live on $45,000 a year in a big city?

It’s extremely difficult. In cities like Chicago, Seattle, or Austin, a one-bedroom apartment costs $1,800 to $2,500 a month. After rent, taxes, utilities, and transportation, there’s little left for food or emergencies. Most people in these areas need at least $60k-$70k to live without relying on savings, side gigs, or family support.

What percentage of Americans make $45,000 a year?

About 22% of U.S. workers earn between $40,000 and $49,999 annually, according to 2025 Census data. That’s roughly 35 million people. Many are full-time workers in service, retail, or clerical jobs. This group is the largest segment of the working population that struggles to afford basic housing.

Do housing vouchers help if you make $45,000?

It depends. Most housing voucher programs (like Section 8) are for people earning under 50% of the area median income. In many places, that’s around $35k-$40k for a single person. At $45k, you may not qualify. Some cities have expanded eligibility, but waitlists are often years long. It’s worth applying, but don’t count on it.

How much should you make to afford rent without stress?

To afford a modest one-bedroom apartment without spending more than 30% of your income, you need to make at least $50,000 in low-cost areas and $70,000-$90,000 in high-cost cities. The MIT Living Wage Calculator shows that even in affordable regions, $45k leaves you with almost no room for savings or emergencies.

What Comes Next?

If you’re making $45k and barely keeping up, you’re not failing-you’re fighting a system designed for higher incomes. The solution isn’t personal budgeting hacks. It’s systemic change: more affordable housing units, rent stabilization, wage increases tied to inflation, and public investment in housing infrastructure. Until then, you’re not alone. And you’re not broken. You’re just trying to survive in a country that forgot how to value work.