Rent vs. Buy Calculator for Melbourne 2025

Compare Renting vs. Buying in Melbourne

Calculate whether renting or buying makes more financial sense for your situation in 2025 based on current Melbourne property market conditions.

Results

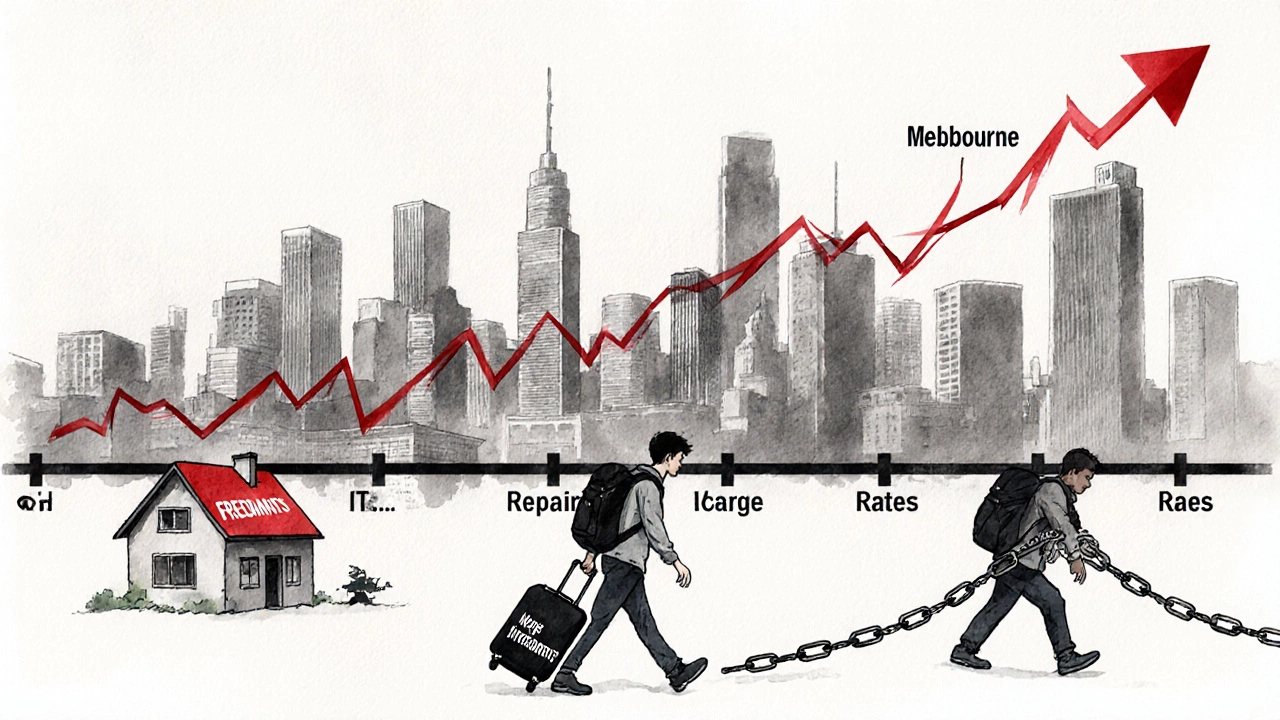

Note: The break-even point is when total ownership costs equal total renting costs. In Melbourne's current market, it typically takes 7+ years to break even after accounting for upfront costs and interest.

Buying a house used to be the default next step after getting a job, getting married, or turning 30. But now? It’s not so clear. With interest rates still above 6%, rents rising in Melbourne, and wages barely keeping up, more people are asking: Is it really smart to buy a house? The answer isn’t yes or no. It depends on your money, your life plan, and whether you’re ready to treat your home like a financial asset - not just a place to sleep.

Homeownership isn’t what it used to be

Twenty years ago, a median house in Melbourne cost about $250,000. Today, it’s over $950,000. That’s not inflation. That’s a system change. Wages went up 45% in that time. House prices went up 280%. The gap isn’t closing. It’s widening. And banks aren’t making it easier. Lenders now require 20% deposits for most loans - and even then, they check your spending habits like a detective. If you’re buying coffee every morning or ordering takeout twice a week, they’ll count that as a red flag. Your lifestyle, not just your salary, determines if you qualify.

And here’s the thing most people miss: owning a house doesn’t mean you’re building wealth. It means you’re paying for the privilege of owning something that costs you thousands every year. Property taxes, insurance, repairs, water rates, strata fees - those aren’t optional. A $950,000 home in Melbourne might cost you $1,800 a year just in council rates and insurance. Add $300 a month for maintenance? That’s $3,600 a year. That’s more than most people pay in rent for a similar property.

What you’re really paying for

Let’s say you buy a house for $950,000 with a 20% deposit. That’s $190,000 upfront. You borrow $760,000 at 6.25%. Your monthly mortgage payment? Around $4,700. That’s not counting rates, insurance, or repairs. Now compare that to renting a similar house for $3,800. You’re paying $900 extra a month to own. That’s $10,800 a year. Over five years? $54,000. And that’s before you factor in the cost of fixing the leaky roof, replacing the hot water system, or repainting the exterior.

People think they’re saving money by owning. But if you’re not putting that $900 a month into investments - not just into your mortgage - you’re not building wealth. You’re just paying more to live in a bigger space. And if you sell in five years and the market flatlines? You might walk away with less than you put in after fees and interest.

When buying makes sense

There are real cases where buying is smarter than renting. First: you plan to stay put for at least seven years. That’s the magic number. It’s how long it usually takes to break even after paying stamp duty, legal fees, agent commissions, and mortgage interest. If you move before then? You’re likely losing money.

Second: you can afford the upfront costs without draining your emergency fund. You need 20% for the deposit, plus another 5-7% for fees. That’s $60,000 to $80,000 extra on top of the deposit. Most people don’t have that. If you’re using your last $10,000 for legal fees, you’re setting yourself up for disaster when the washing machine breaks or you lose your job.

Third: you’re not relying on property to be your only retirement plan. Too many Australians think their house will fund their golden years. But what if you need to move for care? What if the market crashes? What if you have to sell to pay for aged care? Your home isn’t liquid. It’s not cash. It’s a locked-up asset that takes months to sell and costs 2-3% just to list it.

The hidden traps

One big trap? Assuming your house will always go up in value. The Reserve Bank of Australia warned in 2024 that Australian housing is overvalued by 15-20%. That’s not a rumor. That’s official. And when markets correct, they don’t do it slowly. Sydney and Melbourne saw 10-15% drops in 2022. People who bought at the peak lost tens of thousands in equity overnight. If you’re counting on your house to grow your net worth, you’re gambling - not investing.

Another trap? Buying a house because you think it’s the only way to build credit. It’s not. You can build credit with a secured credit card, a small personal loan, or even a rent-reporting service. You don’t need a $950,000 mortgage to prove you’re financially responsible.

And then there’s the lifestyle cost. Owning a house means you’re tied to it. No spontaneous trip to Bali. No job change across the country. No moving closer to family if your parents get sick. Renting gives you freedom. Buying gives you responsibility - and often, stress.

What renting lets you do instead

Let’s say you rent a $3,800-a-month house. You save the $900 difference each month - the amount you’d be paying extra to own. That’s $10,800 a year. Invest that in an index fund with a 7% average return? In five years, you’ve got $60,000. In ten? $150,000. That’s cash you can use to buy a house later - or fund travel, education, or a business. Or keep it as your safety net.

And here’s the kicker: you can still live in a great home. Melbourne has plenty of modern, well-maintained rentals. You don’t need to own to have a good life. You just need to be smart with your money.

Who should still buy?

If you’re a public servant, nurse, or teacher with a secure job and a 20-year plan to stay in one place? Buying makes sense. You get stability. You get control over renovations. You get tax benefits if you rent out part of it later.

If you’re planning to start a family and want to lock in housing costs? Buying can help. Renters in Melbourne saw increases of 8-12% in 2024. Locking in a mortgage at 6.25% now means your payment won’t rise - unless you refinance.

If you have family support? A gift from parents for the deposit? That changes the game. It reduces your risk. It gives you breathing room. That’s not cheating. That’s strategy.

And if you’re the kind of person who hates paying rent and wants to feel like you’re building something? That’s valid. But ask yourself: are you doing it for emotion - or economics?

What to do next

Don’t rush. Don’t let FOMO push you into a decision. Here’s what to do instead:

- Run the numbers: Use a mortgage calculator. Add in all costs - not just the loan. What’s your total monthly outlay?

- Compare to rent: Find three similar rentals. What’s the average? How much would you save by renting?

- Check your emergency fund: Do you have at least six months of living expenses saved? If not, wait.

- Look at your job: Is it stable? Could you work remotely? Could you move for a better role? If yes, renting gives you flexibility.

- Wait six months: The market shifts. Rates might drop. Inventory might rise. Don’t feel like you’re missing out. You’re protecting your future.

There’s no shame in renting. There’s no prize for being the first to buy. The smartest move isn’t the fastest one. It’s the one that keeps you financially safe, flexible, and free.

Bottom line

Is it smart to buy a house? Only if you can afford it without risking your future. If you’re stretching your budget, draining your savings, or ignoring the hidden costs - it’s not smart. It’s risky. And in 2025, risk doesn’t pay off like it used to.

Homeownership isn’t a right. It’s a choice. And the best choice is the one that gives you freedom - not debt.

Is it better to rent or buy in Melbourne in 2025?

In Melbourne, renting is often the smarter financial choice in 2025. With median house prices over $950,000 and mortgage rates above 6%, the monthly cost of owning is typically $900-$1,200 higher than renting a similar property. Renting lets you invest that difference elsewhere, avoid repair costs, and keep your mobility. Only buy if you plan to stay seven+ years, have a 20% deposit plus emergency savings, and aren’t relying on property to fund your retirement.

How much do I need to earn to buy a house in Melbourne?

To buy a $950,000 home with a 20% deposit, you typically need a combined household income of at least $140,000-$160,000. Lenders use a debt-to-income ratio of 30-35%, meaning your mortgage payment can’t exceed 30% of your gross income. That means a $4,700 monthly mortgage requires $15,600 in monthly income before tax. Most people don’t qualify without a co-signer, a large deposit, or very low spending habits.

Can I buy a house with less than 20% deposit?

Yes, but it’s risky. You can get a loan with as little as 5% deposit through Lenders Mortgage Insurance (LMI). But LMI costs $20,000-$40,000 on a $950,000 home, and you pay it upfront or add it to your loan. That means you start with negative equity. If prices drop, you owe more than the house is worth. Most financial advisors say avoid this unless you’re in a secure job and have a 10+ year plan.

What are the hidden costs of owning a house?

Beyond your mortgage, you pay council rates ($1,500-$2,500/year), insurance ($800-$1,500/year), maintenance ($300-$600/month), water bills, landscaping, and unexpected repairs. A leaking roof or broken HVAC system can cost $5,000-$15,000. These aren’t optional. Renters don’t pay these - landlords do.

Should I wait for interest rates to drop before buying?

Waiting is usually the better move. Rates are expected to fall in late 2026 or 2027. In the meantime, renting gives you time to save more, improve your credit, and wait for better inventory. The market isn’t going anywhere. If you wait 12-18 months, you might find lower prices, more choices, and better loan terms. FOMO isn’t a strategy.

Is buying a house still a good investment?

Not always. In 2025, housing in Australia is overvalued by 15-20% according to the Reserve Bank. Historically, homes return 3-4% annually after inflation - less than the stock market. Your house isn’t an investment unless you rent it out or flip it. If you live in it, it’s a lifestyle choice. Treat it like a car, not a stock.