Virginia Rental Property Cost Estimator

Estimated Annual Rental Expenses

Property Tax

$1,200 – $2,500

Insurance

$800 – $1,200

Maintenance/Repairs

$1,000 – $3,000

Vacancy Loss

5% – 10% of annual rent

Advertising

$100 – $300

Legal & Accounting

$300 – $600

Total Estimated Annual Expenses

Range: $3,400 – $8,100

Average: $5,750

Thinking about handling your own rental unit in Virginia? You can, but you’ll need to juggle legal duties, money matters, and everyday hassles that most DIY landlords underestimate. Below is a step‑by‑step guide that shows exactly what you’ll handle, where the biggest costs lie, and when it’s smarter to call in a pro.

Legal Foundations You Can’t Ignore

First, get the rulebook straight. Virginia Residential Landlord and Tenant Act (VRLTA) is the core statute that governs most landlord‑tenant relationships in the Commonwealth. It spells out everything from how much notice you must give before entering a unit to the timeline you have to return a security deposit after a lease ends. Violating VRLTA can cost you fines or even a lawsuit.

On top of VRLTA, the Virginia Fair Housing Act prohibits discrimination based on race, color, religion, sex, national origin, familial status, or disability. Treat every applicant the same way and keep written records of your screening criteria.

Finally, know the eviction process. It’s a court‑driven procedure; you can’t simply change the locks. If a tenant falls behind, you must serve a proper notice, wait the statutory period, and then file a complaint in the General District Court.

Core Responsibilities of a Self‑Managing landlord

- Advertising and tenant screening: Write a clear listing, interview prospects, run credit and background checks, and verify income.

- Drafting a lease: Use a written lease agreement that complies with VRLTA, includes rent amount, due date, late‑fee schedule, pet policy, and maintenance rules.

- Collecting rent: Set up a reliable payment method (online portal, ACH, or certified check). Follow the state‑mandated grace period and apply late fees only if allowed.

- Maintenance and repairs: Keep the property habitable. Respond to emergency repairs within 24hours, and schedule routine upkeep (HVAC, smoke detectors, landscaping).

- Financial reporting: Track income, expenses, and depreciation for tax purposes. You’ll need to file Schedule E on your federal return.

- Legal compliance: Stay current on local zoning, building codes, and required disclosures (lead‑based paint, mold).

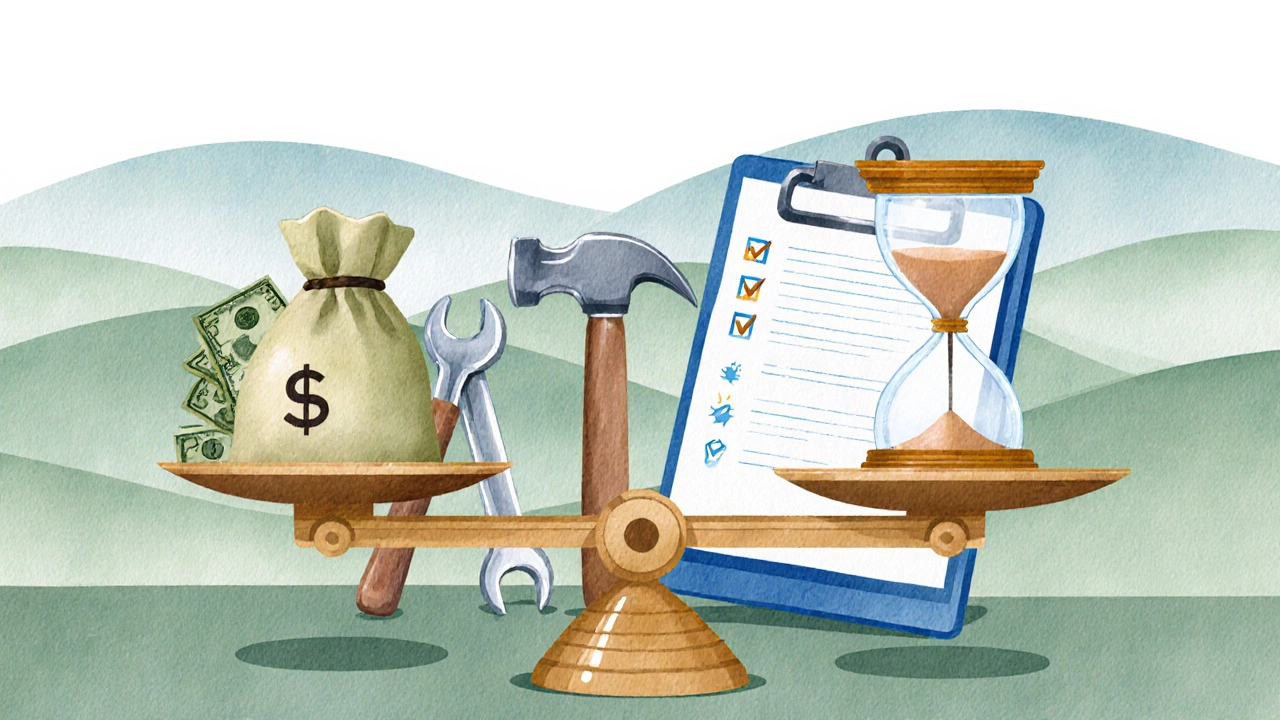

Financial Implications: What Costs Add Up

Running a rental isn’t free. Here’s a quick snapshot of the major line items you’ll see each year:

| Expense | Average Cost (USD) | Notes |

|---|---|---|

| Property tax | $1,200 - $2,500 | Varies by county; assessed value is key. |

| Insurance (landlord policy) | $800 - $1,200 | Covers property damage and liability. |

| Maintenance/repairs | $1,000 - $3,000 | Includes emergency fixes and routine upkeep. |

| Vacancy loss | 5‑10% of annual rent | Plan for turnover time (30‑45 days typical). |

| Advertising | $100 - $300 | Online listings, signage, or agent fees. |

| Legal & accounting | $300 - $600 | Attorney for lease drafts, CPA for taxes. |

Compare this to the typical property management company fee of 8‑12% of collected rent. In many cases, the percentage covers rent collection, tenant placement, and day‑to‑day maintenance coordination, but it also adds a constant overhead that can eat into profit.

Finding and Screening Tenants the Right Way

Good tenants are the foundation of a smooth operation. Follow this workflow:

- Post a detailed ad on platforms like Zillow, Craigslist, and local Facebook groups.

- Require an application that asks for employment info, rental history, and references.

- Run a credit check (score620+is usually acceptable) and a background check for criminal history.

- Verify income - aim for monthly rent ≤ 30% of gross income.

- Document every step to stay compliant with the Fair Housing Act.

Once you pick a tenant, have them sign the lease electronically or on paper, and collect the first month’s rent plus the security deposit before they move in.

Day‑to‑Day Operations You’ll Handle

- Rent collection: Use an online portal like Buildium or a simple bank ACH setup. Send reminders 3 days before due date.

- Maintenance requests: Set up a dedicated email or a ticket system. Prioritize emergencies (no heat, water leak) over cosmetic fixes.

- Inspections: Conduct a move‑in walkthrough with a checklist, then repeat annually and at move‑out.

- Record‑keeping: Keep digital copies of leases, receipts, and correspondence in a cloud folder-helps during tax season and legal disputes.

- Legal notices: Use template letters for late rent, lease violations, or notice to vacate. Make sure timing matches VRLTA requirements.

Self‑Manage vs. Hiring a Property Manager: Quick Comparison

| Factor | Self‑Manage | Property Management Co. |

|---|---|---|

| Initial time investment | High - you handle ads, showings, paperwork. | Low - they do the legwork. |

| Monthly cost | Variable - mainly repairs and taxes. | 8‑12% of rent + occasional placement fee. |

| Legal compliance | All responsibility on you. | Company provides vetted lease and notice templates. |

| Control over tenant selection | Full control. | Limited - they follow screening standards. |

| Scalability | Hard - time caps number of units. | Easy - they can manage dozens. |

If you own just one or two units and enjoy hands‑on work, self‑managing can boost cash flow by up to 15% compared with a manager’s fee. Once you cross three units or have a full‑time job, the time cost often outweighs the savings.

Common Pitfalls and Pro Tips

- Skipping the written lease: Verbal agreements are hard to enforce. Always have a signed document.

- Under‑estimating vacancy periods: Budget for at least 8% vacancy in cash‑flow calculations.

- Not separating personal and business finances: Open a dedicated bank account and consider an LLC to protect personal assets.

- Neglecting regular inspections: Small issues (leaky faucet, cracked window) become costly if ignored.

- Ignoring tax deductions: Track mileage for property visits, home‑office work, and depreciation on the building’s structure.

Pro tip: Keep a 30‑day “emergency fund” equal to one month’s rent to cover unexpected repairs without hurting your cash flow.

Frequently Asked Questions

Do I need a Virginia real‑estate license to manage my own rental?

No. A license is only required if you charge others for managing properties on their behalf. Managing your own unit is considered a personal activity.

What is the maximum security‑deposit amount I can charge?

Virginia does not set a legal cap, but most landlords charge one month’s rent. Anything higher should be justified in the lease to avoid disputes.

Can I evict a tenant for having a pet if my lease says no pets?

Yes, as long as the lease includes a clear pet‑restriction clause and you follow the proper notice period (usually 30 days). Be aware of any local ordinances that might limit pet bans.

How often must I renew the lease?

There is no statutory renewal schedule. Most landlords use 12‑month terms and offer a month‑to‑month renewal after it expires.

What tax deductions can I claim as a landlord?

You can deduct mortgage interest, property tax, insurance premiums, repairs, utilities (if you pay them), advertising costs, legal fees, and depreciation on the building’s structure.

Managing a rental in Virginia is definitely doable, but it demands a solid grasp of law, diligent bookkeeping, and a willingness to handle the day‑to‑day grind. Use the checklist above, keep your records tight, and you’ll turn a modest property into a reliable income stream.