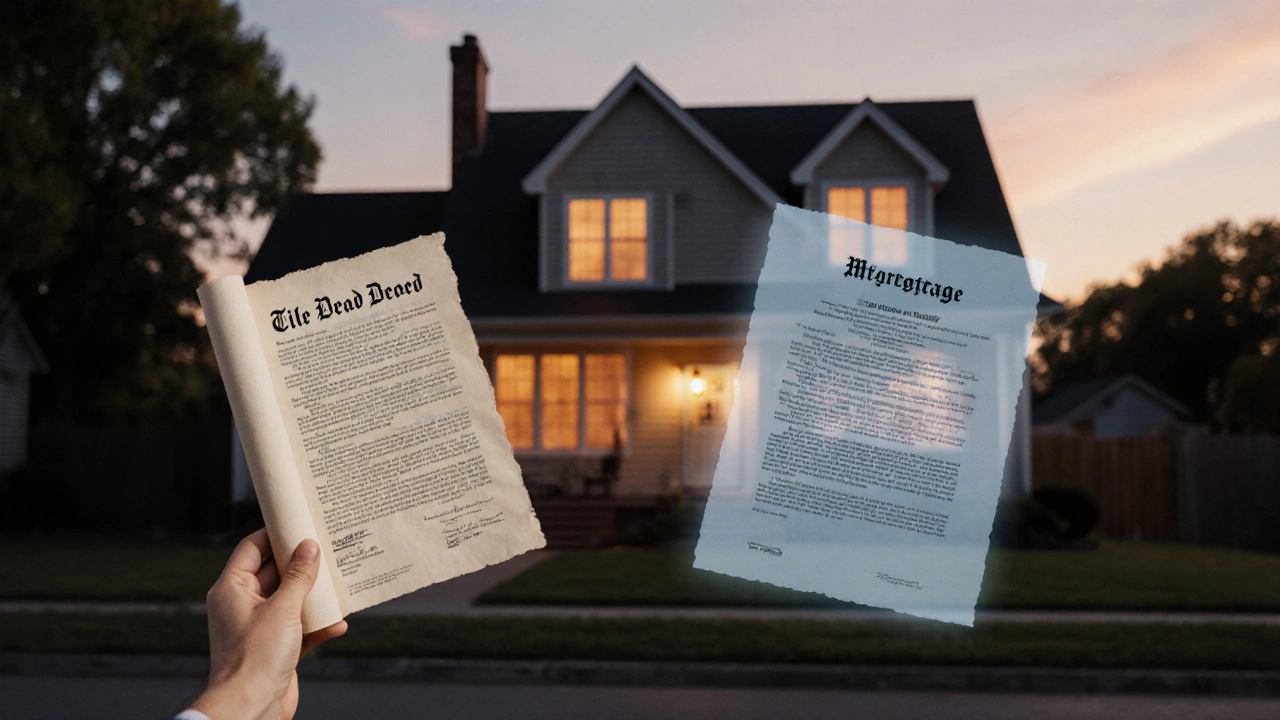

Mortgage Basics and How to Secure the Best Home Loan

If you’re thinking about buying a house, the word "mortgage" probably shows up a lot. It can feel overwhelming, but the core ideas are simple. A mortgage is just a loan for real estate, paid back over many years with interest. Understanding the key pieces—rate, term, down payment, and credit score—helps you avoid surprises and get a deal that works for you.

Understanding Mortgage Rates

Mortgage rates are the cost of borrowing money, expressed as a percentage. They come in two main flavors: fixed and adjustable. A fixed‑rate loan stays the same for the whole term, so your monthly payment won’t change. An adjustable‑rate mortgage (ARM) starts lower but can rise or fall after a set period. Which one is right depends on how long you plan to stay in the house and how comfortable you are with potential payment changes.

Rates are influenced by the economy, the Federal Reserve, and your personal credit profile. Better credit scores usually lock in lower rates. If you’re around 740 or higher, you’re in the sweet spot for the most competitive offers. Even a 0.25% difference can save you thousands over a 30‑year loan, so it’s worth the effort to improve your score before you apply.

Steps to Get Approved

1. Check Your Credit – Pull a free report, fix any errors, and pay down high balances. A clean report makes lenders view you as low risk.

2. Save for a Down Payment – The standard is 20% of the home price, but many programs let you put down as little as 3%. Keep in mind that a smaller down payment often means you’ll pay private mortgage insurance (PMI) until you reach 20% equity.

3. Gather Documents – Lenders will ask for recent pay stubs, tax returns, bank statements, and proof of any other income (like freelance work or rentals). Having these ready speeds up the process.

4. Shop Around – Don’t settle for the first offer. Use a mortgage calculator to compare monthly payments, total interest, and fees from at least three lenders. Online tools let you see rates side by side without affecting your credit.

5. Lock Your Rate – Once you find a good rate, ask the lender to lock it in. Lock periods usually last 30‑60 days and protect you from market jumps before closing.

6. Close the Deal – At closing, you’ll sign paperwork, pay closing costs (usually 2‑5% of the loan amount), and the mortgage becomes official. Review every document, and don’t hesitate to ask the loan officer to explain anything unclear.

Remember, a mortgage isn’t just a financial commitment; it’s a long‑term partnership with your lender. Staying on top of payments, refinancing when rates drop, and occasionally checking your loan’s terms can keep your home financing healthy for years to come.

Use the tips above, run a few numbers with a mortgage calculator, and you’ll feel more confident walking into the bank. A solid mortgage plan puts you on the fast track to owning the home you’ve been dreaming about.

Homeowner or Borrower? How a Mortgage Affects Your Property Ownership

by Arjun Mehta Oct 20 2025 0 Property RegistrationExplore whether a mortgage affects your homeowner status, understand rights, registration steps, and key misconceptions in clear, practical terms.

READ MOREExplore the Duration of Living Mortgage-Free in Your Home

by Arjun Mehta Dec 22 2024 0 Real EstateNavigating the uncertain waters of living in your home without immediately settling your mortgage payments can be crucial for homeowners. While it might sound appealing, understanding the legal implications, timelines, and risk of foreclosure is essential. Comprehending how lenders operate and your rights can save you from facing unexpected evictions. Discover the factors that influence how long you can stay in your home without making mortgage payments and strategies to manage this period more effectively.

READ MORE