Commercial Property Platform Selector

Find Your Ideal Commercial Property Platform

Select your priorities to get personalized recommendations for commercial property platforms based on coverage, data depth, and pricing models.

Finding a commercial property that fits your budget, location, and size requirements used to mean flipping through endless print ads or calling dozens of brokers. Today, a handful of dedicated commercial property website platforms bring thousands of listings to your screen, letting you compare options in minutes. Below we break down the most reliable sites, how to pick the right one, and common pitfalls to avoid.

How to Choose the Right Commercial Property Platform

Before we rank the sites, understand the criteria that separate a good portal from a mediocre one. The following factors matter most for investors, tenants, and developers:

- Coverage: Does the site list properties in the regions you target? Some focus on the U.S., others go global.

- Data depth: Look for square‑footage, lease terms, price history, and zoning details. The richer the dataset, the less research you have to do later.

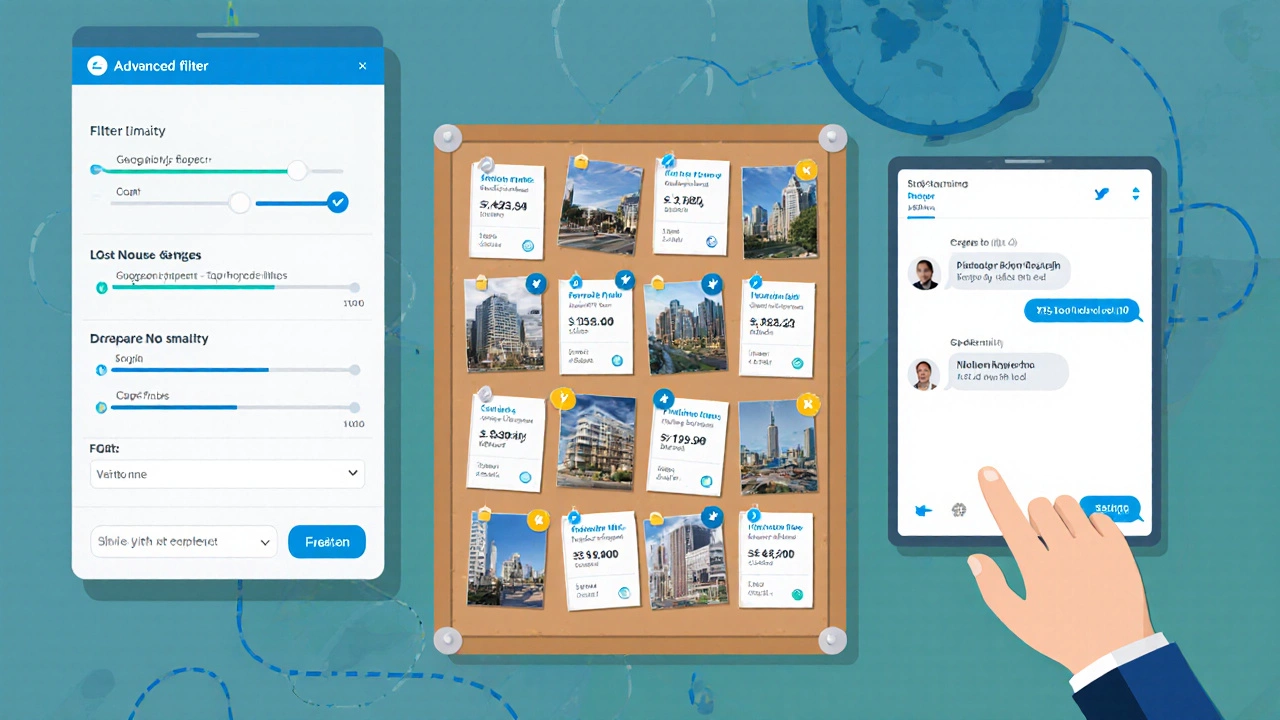

- Search filters: Advanced filters (e.g., cap rate, build‑to‑suit, anchor tenant) save hours.

- Pricing model: Free access, subscription, or pay‑per‑listing affects how often you can browse.

- User experience: Clean UI, responsive design, and reliable map integration keep the hunt painless.

Keep these points in mind as you scan the comparison table; the site that scores highest across the board will likely be your best bet.

Top Commercial Property Websites in 2025

Below is a snapshot of the most popular platforms, based on coverage, data richness, pricing, and user feedback from the past year.

| Website | Coverage | Fee Model | Key Features | Best For |

|---|---|---|---|---|

| LoopNet is a leading U.S.-centric commercial listings portal with over 500,000 active properties | U.S. (all 50 states) | Free basic, $79/mo premium | High‑resolution maps, tenant‑representation tools, broker contact integration | Broad market searches, first‑time investors |

| CoStar provides comprehensive data and analytics for commercial real estate professionals | U.S. + select international markets | Enterprise subscription (starts at $1,200/mo) | Deep market analytics, historic transaction data, AI‑driven property valuation | Large investors, corporate real estate teams |

| Crexi offers a modern marketplace with real‑time bidding and transaction management | U.S. and Canada | Free basic, $49/mo Pro | Instant offers, secure document storage, integrated escrow | Deal‑makers who need fast closures |

| Brevitas specializes in private, off‑market listings for high‑value assets | Global (focus on Europe & North America) | Invitation‑only, subscription varies | Confidential listings, vetted broker network, advanced financial modeling | Institutional investors, REITs |

| PropertyShark combines public records with commercial listings for deep due‑diligence | U.S. (major metros) | $99/mo individual, $399/mo team | Parcel maps, ownership history, tax data, flood zone info | Investors needing granular property data |

| CityFeet focuses on urban office and retail spaces in key U.S. cities | Top 30 U.S. metros | Free basic, $69/mo premium | City‑level market trends, lease‑rate heat maps | Businesses seeking downtown locations |

| Reonomy leverages AI to surface hidden commercial asset opportunities | U.S. (nationwide) | Custom pricing (starts around $500/mo) | Owner contact intelligence, predictive analytics, API access | Tech‑savvy investors, data‑driven firms |

| Total Commercial offers a curated marketplace of industrial and warehouse assets | U.S. Gulf Coast, Midwest, Pacific Northwest | Free listings, $59/mo premium | 3D virtual tours, load‑capacity filters, logistics proximity tools | Supply‑chain operators, e‑commerce fulfillment planners |

| Zillow Commercial extends Zillow’s residential brand into commercial space listings | U.S. (select markets) | Free | Consumer‑friendly UI, integrated mortgage calculators, neighborhood stats | Small business owners and first‑time commercial buyers |

Step‑by‑Step Guide to Using a Commercial Property Website Effectively

- Define your criteria. List the minimum square footage, budget range, desired lease term, and any zoning constraints.

- Create an account. Most platforms require a free profile; premium accounts unlock detailed financial data.

- Apply filters. Use the advanced search to narrow by cap rate, property type (office, industrial, retail), and distance to transportation hubs.

- Save and compare. Bookmark promising listings, export data to an Excel sheet, and use the site’s comparison tool (if available).

- Contact the broker. Send a concise inquiry referencing the listing ID; include your timeline and financing status.

- Run due diligence. Pull ownership records from PropertyShark, verify zoning via local government GIS, and request a site visit.

- Make an offer. If the platform offers built‑in transaction tools (e.g., Crexi), you can submit a formal offer directly through the portal.

Following these steps keeps you organized and speeds up the acquisition process, no matter which site you choose.

Common Mistakes to Avoid

Even seasoned investors slip up when navigating online listings. Here are pitfalls you should watch out for:

- Relying on outdated data. Some free listings refresh monthly; always check the “last updated” timestamp.

- Ignoring additional fees. Premium subscriptions may hide transaction fees or data‑pull costs.

- Overlooking off‑market opportunities. Platforms like Brevitas and Reonomy provide hidden deals that aren’t advertised publicly.

- Skipping geographic nuances. A property’s address may be in a high‑tax zone or floodplain; cross‑reference with local tax maps.

- Not leveraging the platform’s analytics. CoStar’s market reports can reveal trending cap rates that affect your offer price.

Future Trends: What to Expect from Commercial Property Portals

Technology is reshaping how space is bought and sold. Expect to see:

- AI‑driven property matching. Platforms will suggest listings based on your browsing history and investment criteria.

- Integrated virtual reality tours. Instead of traveling to a warehouse, you’ll walk through a 3‑D model on your headset.

- Blockchain‑based title records. Secure, immutable ownership data will reduce title search time.

- API access for large firms. Companies will pull live data feeds into their own analytics stacks.

Staying on platforms that invest in these features gives you a competitive edge.

Quick Checklist Before You Commit

- Verify the site’s coverage matches your target market.

- Confirm you have access to the data depth you need (e.g., cap rates, tax info).

- Calculate total cost of ownership - subscription + transaction fees.

- Test the platform’s support - quick broker responses matter.

- Cross‑check at least two sources to avoid stale listings.

With this checklist in hand, you can confidently pick the site that aligns with your investment strategy.

Which commercial property website offers the most free listings?

LoopNet provides the largest pool of free commercial listings, though premium accounts unlock deeper data and contact details.

Do any sites specialize in off‑market industrial properties?

Brevitas and Reonomy focus heavily on off‑market and private listings, especially for industrial and logistics assets.

How reliable are the cap‑rate figures on these platforms?

CoStar and Crexi aggregate cap‑rate data from recent transactions, making them among the most reliable sources. Always cross‑check with your own market analysis.

Can I negotiate directly through a commercial property website?

Crexi and LoopNet allow you to message brokers and sometimes submit offers directly through the platform, but final negotiations often move to email or phone.

Is a premium subscription worth it for a small business?

If you need detailed financials, ownership history, or need to view many listings quickly, a modest premium plan on LoopNet or CityFeet can save time and uncover better deals.