Villa Ownership Cost Calculator

Your Estimated Annual Costs

Compared to apartment: Your villa costs $ more annually.

Average Melbourne apartment: $1,800-$2,500/month

Buying a villa sounds like a dream-private gardens, space to breathe, no shared walls. But if you’ve ever lived in one, you know the dream comes with a heavy price tag you might not see until it’s too late. Villas aren’t just bigger houses. They’re high-maintenance assets that demand time, money, and effort most people don’t plan for. If you’re considering buying one, here’s what no sales brochure will tell you.

High Maintenance Costs Add Up Fast

A villa isn’t just a bigger living room. It’s more roof, more walls, more windows, more land. All of it needs care. In Melbourne, a 300-square-meter villa with a 500-square-meter garden can easily cost $8,000 to $15,000 a year just in upkeep. That’s not including major repairs. Roof replacements? $20,000. Pool cleaning and chemical upkeep? $3,000 minimum. Landscaping? Another $4,000 if you hire professionals. Most people think they’ll handle it themselves. Then winter hits, the gutters clog, the lawn turns to mud, and suddenly you’re paying for a service you didn’t budget for.

Energy Bills Are a Shock

Villas are energy hogs. High ceilings, large windows, open-plan layouts-they’re beautiful, but they’re terrible for insulation. In Melbourne’s cold winters, heating a 400-square-meter villa can cost $300 to $500 a month. In summer, cooling it? Another $250 to $400. Compare that to a standard 150-square-meter townhouse, where heating and cooling rarely exceed $100 a month. You’re not just paying for square footage-you’re paying for the inefficiency of space. Double-glazed windows and insulation help, but retrofitting an existing villa? That’s a $15,000+ job.

Security Is Harder to Manage

More space means more entry points. A villa often has three or four doors, multiple windows on the ground floor, a backyard fence, a gate, maybe even a pool area. All of these are potential weak spots. A standard apartment has one main entrance, monitored by a building manager. A villa? You’re alone. You need a full security system-cameras, motion sensors, alarms, smart locks. Add in regular patrols if you’re away often. That’s another $2,000 to $5,000 upfront, plus $100 a month in monitoring fees. And if you forget to arm the system? You’re on your own.

Isolation Can Be Real

Villas are often built on larger blocks, away from the bustle of town centers. That’s great if you want quiet. But it’s a problem if you need to run errands, catch public transport, or just walk to the corner store. In Melbourne, many villas sit in suburbs like Wantirna, Mooroolbark, or Ringwood-areas where public transport is sparse. You’ll need at least one car, often two. Fuel, insurance, registration, parking-add $1,200 to $2,000 a year just for transport. And if you’re elderly or don’t drive? You’re stuck. Social isolation isn’t just a buzzword-it’s a real risk in sprawling villa neighborhoods.

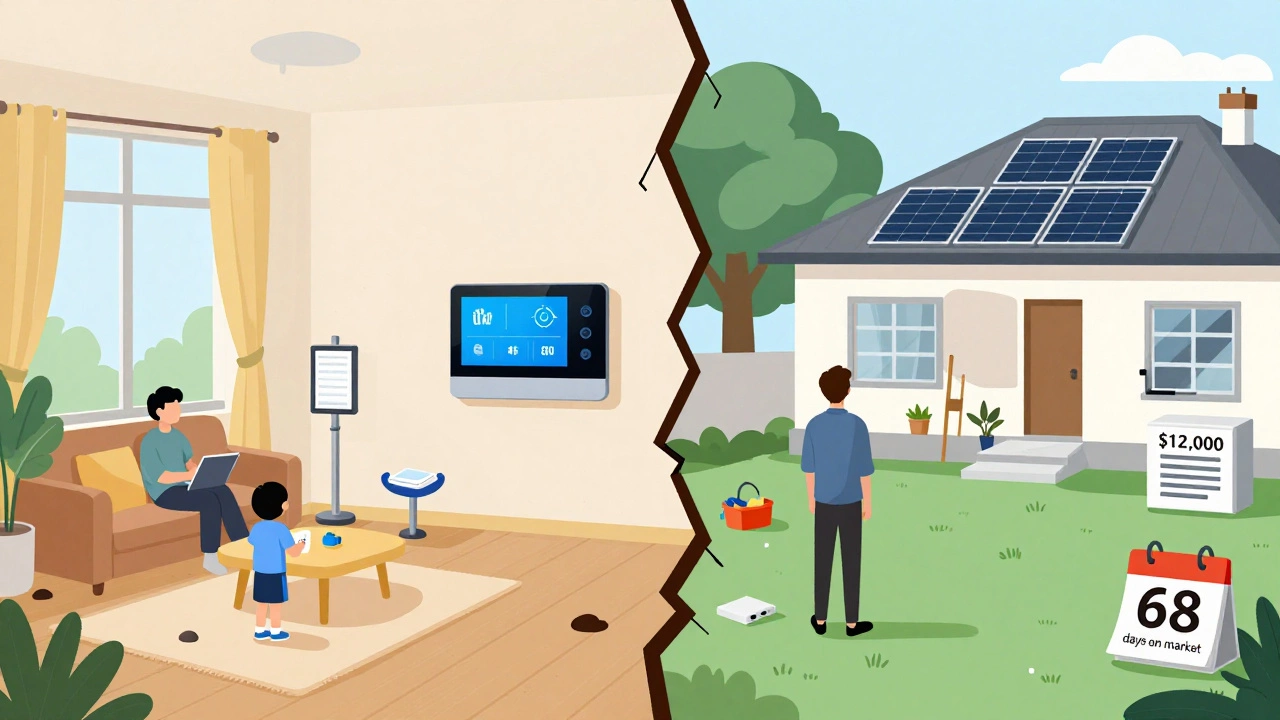

Resale Value Isn’t Guaranteed

Many buyers think villas hold value better than apartments. That used to be true. But now? The market is shifting. Younger buyers want low-maintenance living. Downsizers want to escape yard work. Investors want higher rental yields, and villas rarely deliver them. A 4-bedroom villa in a good Melbourne suburb might rent for $2,800 a month. A modern 2-bedroom apartment nearby? $3,500. And it’s easier to sell. Villas sit on the market longer. In 2024, the average time on market for a villa in Melbourne was 68 days. For apartments? 42 days. That’s two extra months of mortgage payments, rates, and insurance with no income.

Renovations Are a Nightmare

Want to knock down a wall? Add a bathroom? Extend the kitchen? With a villa, you’re not just dealing with your own house-you’re dealing with zoning laws, heritage restrictions (if it’s an older property), and council approvals. Many villas built in the 1970s and 80s sit on blocks with strict setback rules. You can’t build a shed without council permission. You can’t raise the roof without an engineer’s report. And if you want to install solar panels? You need to check if your roof structure can handle the weight. A simple kitchen upgrade can take 6 months and cost $80,000. In an apartment, you’d do it in 6 weeks for $30,000.

Community Rules Can Be Worse Than You Think

Not all villas are standalone. Many are part of gated communities or estate developments with body corporate rules. These aren’t just about aesthetics-they dictate everything. No clotheslines in view. No fences taller than 1.8 meters. No parking on the driveway if it’s visible from the street. You can’t even plant certain trees without approval. Some estates charge monthly fees of $300 to $600 for landscaping, security, and common area maintenance. You’re paying for a lifestyle you didn’t ask for-and you can’t opt out.

You’re Alone in the Storm

When the roof leaks, you fix it. When the sewer backs up, you call the plumber. When the fence collapses after a storm, you pay for the repair. In an apartment, you call the building manager. They handle it. In a villa? You’re the manager. There’s no one to share the burden. That’s fine if you’re handy, retired, or have a big budget. But if you’re working full-time, have kids, or just want to relax? You’ll be stressed. And if something breaks while you’re away? It can turn into a disaster.

Who Should Avoid a Villa?

Not everyone should buy one. Avoid a villa if:

- You work 50+ hours a week and don’t have time for yard work

- You’re on a fixed income or tight budget

- You plan to move in 5 years or less

- You rely on public transport

- You’re not handy or don’t want to hire help

- You dislike dealing with councils, contractors, or permits

On the flip side, villas make sense if you’re retired, have a big family, love gardening, or plan to live there for 15+ years. But even then, make sure you’ve budgeted for the hidden costs.

Final Reality Check

A villa isn’t a status symbol. It’s a long-term commitment with hidden expenses that creep up slowly. Most people fall in love with the photos-sunlight on the lawn, the infinity pool, the open kitchen. But they don’t see the $12,000 roof repair, the 3-hour weekend spent fixing the irrigation, or the loneliness of being the only family on a 2,000-square-meter block. Before you sign a contract, walk through the house with a checklist: What will it cost to maintain? How will you heat it? Who will fix it when it breaks? What happens if you need to sell quickly? If the answers scare you, look at a townhouse. You’ll get most of the space, with half the headaches.

Are villas worth the extra cost?

Only if you plan to live there long-term, have the budget for upkeep, and enjoy hands-on property management. For most people, the added cost in maintenance, energy, and time outweighs the benefits. A well-located townhouse or modern apartment often offers better value and lower stress.

Do villas appreciate in value faster than apartments?

Not anymore. In Melbourne, apartments in inner suburbs have outperformed villas in price growth over the last 5 years. Villas on large blocks in outer suburbs are harder to sell and often sit longer on the market. Demand is shifting toward low-maintenance living, especially among younger buyers and downsizers.

Can I reduce villa maintenance costs?

Yes, but it takes upfront work. Install drought-tolerant native plants to cut watering. Use smart irrigation systems. Upgrade to energy-efficient windows and insulation. Switch to solar panels and a heat pump for heating and cooling. Install a security system to avoid insurance hikes. These cost $10,000-$25,000 upfront but can cut annual expenses by 30-50% over time.

What’s the average monthly cost of owning a villa in Melbourne?

On average, a 300-400 sqm villa in Melbourne costs $2,500-$4,000 a month to own. That includes mortgage, rates, insurance, utilities, and maintenance. Compare that to a 150 sqm apartment at $1,800-$2,500. The difference isn’t just in rent-it’s in hidden responsibilities.

Are villas good for renting out?

Rarely. Villas usually rent for less per square meter than modern apartments. Tenants prefer low-maintenance properties with easy access to transport and amenities. A villa with a big yard might attract families, but turnover is slower, and damage costs are higher. You’ll also pay more in property management fees because of the extra work involved.