Cap Rate Calculator

Calculate the capitalization rate for commercial properties using NOI and property value. See how different inputs affect your return.

Cap rate = Net Operating Income ÷ Property Value. A 6% cap rate means $6 per $100 invested annually.

Cap Rate Result

How to Use This Calculator

- Net Operating Income (NOI) = Annual rent income minus operating expenses (taxes, insurance, maintenance, management fees).

- Property Value = Current market price of the property.

- Example: Property value = $2,000,000 NOI = $140,000 Cap rate = 7% (140,000 ÷ 2,000,000)

When you’re looking at a commercial property-like an office building, retail center, or apartment complex-you don’t just care about the price tag. You care about how much money it puts in your pocket each year. That’s where cap rate comes in. It’s the simplest, most direct way to measure the return on a property without worrying about financing. And if you’re buying or selling commercial real estate, not knowing cap rate is like driving without a speedometer.

What Exactly Is Cap Rate?

Cap rate stands for capitalization rate. It’s a percentage that tells you the annual return you’d get on a property if you paid cash for it and didn’t borrow any money. It’s not a forecast. It’s not a guess. It’s a snapshot of current income compared to current price.

Here’s the formula: Net Operating Income (NOI) ÷ Property Value = Cap Rate

Let’s say you’re looking at a small strip mall priced at $2 million. It brings in $180,000 in rent each year. After paying property taxes, insurance, maintenance, and management fees-$40,000 total-you’re left with $140,000 in net operating income. Divide $140,000 by $2 million, and you get a 7% cap rate.

That means if you bought the building with cash, you’d earn 7% back every year, before taxes and before you take any money out. Simple. No loans. No interest. Just pure income versus price.

Why Cap Rate Matters More Than Rent

Many new investors fixate on rent. They see a property with $20 per square foot in rent and think it’s a steal. But rent doesn’t tell you the full story. A building might have high rent but also sky-high taxes, broken elevators, or a tenant who pays late every month. That’s where cap rate cuts through the noise.

Two buildings can both charge $25/sq.ft. in rent. One has a 6% cap rate. The other has a 9% cap rate. The one with the higher cap rate is a better deal-not because it rents for more, but because it costs less relative to its income. It’s more efficient. It’s less risky.

Cap rate also helps you compare apples to apples. You can’t easily compare a warehouse in Ohio to a boutique hotel in Miami just by looking at rent. But you can compare their cap rates. A 7% cap rate in either place means roughly the same return on investment.

What’s a Good Cap Rate?

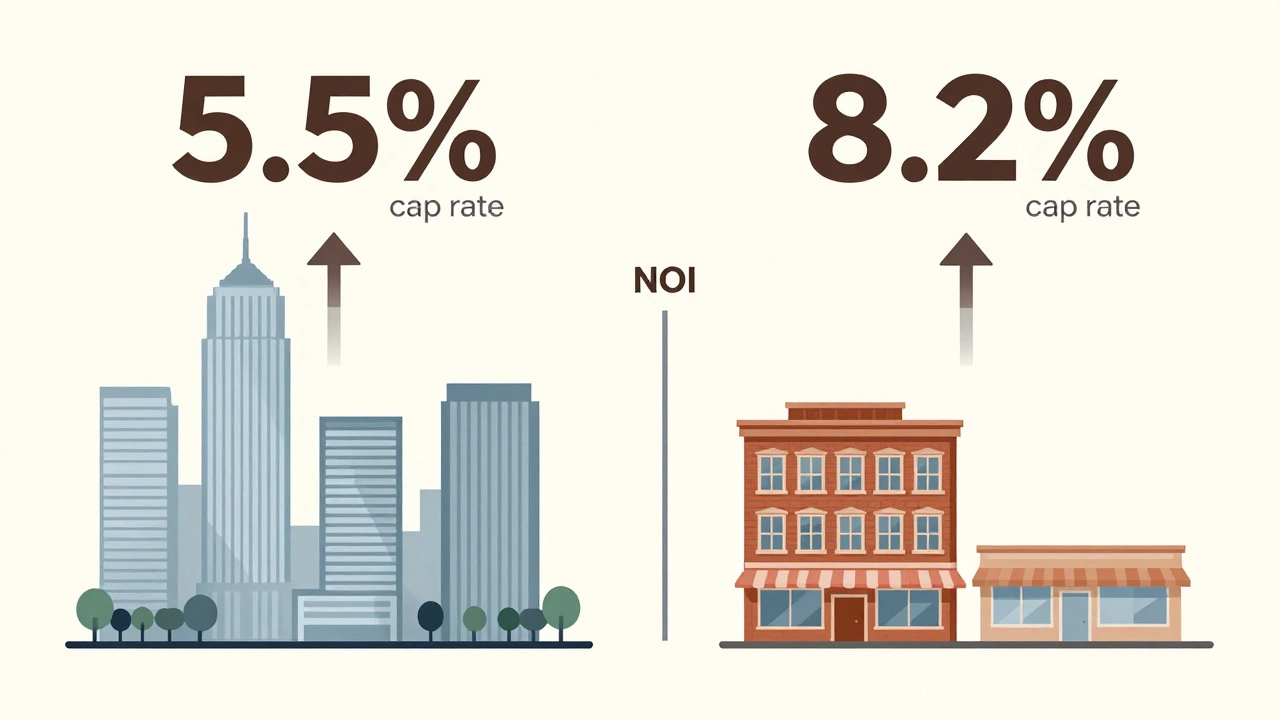

There’s no magic number. Cap rates vary by location, property type, and market conditions. In 2025, here’s what you’re seeing across major U.S. markets:

- Major cities (New York, San Francisco, Chicago): 4.5% to 6%

- Mid-sized cities (Austin, Atlanta, Denver): 5.5% to 7%

- Secondary markets (Cleveland, Memphis, Louisville): 7% to 9%

- Rural or distressed areas: 9% to 12%

Why the difference? High-demand cities have higher prices. Investors pay more because they believe the market will keep growing. That drives cap rates down. In slower markets, prices are lower, so the same income gives you a bigger percentage return.

A 5% cap rate might seem low-but in downtown Los Angeles, it’s normal. A 9% cap rate in a small town might look great, but if the building is 40 years old with no major tenants lined up, it could be a trap. Always look at why the cap rate is what it is.

What Drives Cap Rates Up or Down?

Cap rates aren’t fixed. They move with the economy, interest rates, and tenant demand.

- Interest rates go up? Cap rates tend to rise. Investors demand higher returns to make up for the cost of borrowing.

- Tenants sign long leases? Cap rates fall. Stable income = less risk = higher price = lower cap rate.

- Vacancy spikes? Cap rates rise. Less income = lower value = higher return percentage.

- Property needs major repairs? Cap rates rise. Buyers discount the price because they’ll have to spend money fixing it.

For example, in 2023, cap rates for Class A office buildings in downtown Chicago hovered around 5.8%. By late 2025, with remote work still affecting demand and maintenance costs rising, those same buildings now trade at 7.2%. That doesn’t mean the buildings got worse-it means buyers are demanding more return for the same income stream.

Cap Rate vs. Cash-on-Cash Return

Don’t confuse cap rate with cash-on-cash return. They’re often mixed up, but they measure very different things.

Cap rate ignores financing. It’s all about the property’s income and price.

Cash-on-cash return includes your loan. If you put 30% down on a $2 million property and borrow the rest, your cash-on-cash return might be 12%. But that’s because you only put $600,000 in. The cap rate is still 7%-because it doesn’t care about your loan.

Use cap rate to compare properties. Use cash-on-cash to compare how you’re financing them. One tells you about the asset. The other tells you about your strategy.

How to Use Cap Rate When Buying or Selling

If you’re selling: Know your cap rate before listing. If your property has a 6.5% cap rate and similar buildings in the area are selling at 5.8%, you’re overpriced. You’ll sit on the market. Adjust your price-or improve your NOI by raising rents or cutting expenses.

If you’re buying: Don’t just accept the seller’s cap rate. Verify the numbers. Ask for the last 12 months of rent rolls. Check property tax bills. Ask about upcoming repairs. A seller might say NOI is $150,000-but if they’re not charging market rent or are ignoring a $20,000 roof repair, the cap rate is fake.

Always recalculate cap rate yourself. Use actual numbers, not what the listing says. A 1% difference in cap rate can mean hundreds of thousands in value.

Common Cap Rate Mistakes

- Using gross rent instead of NOI-This inflates the return. Always subtract expenses.

- Ignoring vacancy rates-If a property claims 100% occupancy but has two empty units, adjust the income down.

- Assuming cap rates stay the same-Markets shift. A 6% cap rate today could be 7.5% in 18 months.

- Comparing across property types-A 7% cap rate for a grocery-anchored shopping center is normal. For a single-tenant office building, it’s high. Know your asset class.

One investor bought a 12-unit apartment building in Nashville at a 7.5% cap rate. He assumed it was a steal. Turns out, the seller hadn’t raised rents in five years. Market rent was 30% higher. After raising rents and fixing leaks, the NOI jumped 40%. The cap rate dropped to 5.1%-but the property value went up by $1.2 million. Cap rate doesn’t lie-but the numbers you feed it might.

When Cap Rate Doesn’t Tell the Whole Story

Cap rate is powerful-but it’s not everything. It doesn’t account for:

- Appreciation

- Tax benefits

- Future rent growth

- Market cycles

For example, a property with a 5% cap rate in a growing city like Austin might be a better long-term play than a 9% cap rate in a declining town-even if the 9% looks better on paper. The 5% property could double in value over 10 years. The 9% property might lose value.

That’s why savvy investors use cap rate as a starting point, not the finish line. Pair it with cash flow analysis, tenant quality reviews, and local economic trends.

Final Thought: Cap Rate Is Your First Filter

You wouldn’t buy a car without checking the engine. You shouldn’t buy a commercial property without checking the cap rate. It’s the first number you should calculate-and the one you should question. It’s not a guarantee of success. But it’s the clearest signal you have that a property makes financial sense.

Use it to screen deals. Use it to negotiate. Use it to avoid overpaying. And never, ever trust a cap rate someone else calculated without verifying the numbers yourself.

What is a good cap rate for commercial real estate?

A good cap rate depends on location and property type. In major cities, 4.5% to 6% is common. In mid-sized markets, 5.5% to 7% is typical. In secondary or distressed markets, 7% to 9% or higher is normal. Higher cap rates mean higher risk or lower prices. Lower cap rates mean higher prices and lower risk.

Is a higher cap rate always better?

Not necessarily. A higher cap rate means you’re paying less for the same income-which sounds good. But it often means the property is riskier: older, in a weaker market, or with unstable tenants. A lower cap rate might mean you’re paying more, but the property is stable and likely to appreciate. Focus on risk-adjusted returns, not just the number.

How do I calculate net operating income (NOI)?

Net Operating Income = Total Annual Rental Income − Operating Expenses. Operating expenses include property taxes, insurance, maintenance, management fees, utilities (if paid by owner), and repairs. Do not include mortgage payments, depreciation, or capital improvements.

Does cap rate include property taxes?

Yes. Property taxes are part of operating expenses, so they’re subtracted when calculating NOI, which is used in the cap rate formula. If you don’t include taxes, your cap rate will be artificially inflated and misleading.

Can cap rate be negative?

Yes, if operating expenses exceed rental income. That means the property is losing money. A negative cap rate signals a bad investment unless you’re counting on future appreciation or major renovations to turn it around.