Utah Cost of Living Salary Calculator

Your Utah Living Budget

Your Budget Breakdown

To live comfortably in Salt Lake City as a single adult, you need an annual salary of:

$41,700

After Utah's 4.85% state income tax

Living in Utah doesn’t mean you need to be rich-but you do need to know how much money actually covers rent, groceries, gas, and bills. It’s not just about the salary number. It’s about what that number buys you in Salt Lake City versus Provo versus rural Box Elder County. And if you’re thinking about moving here for the outdoor lifestyle, lower taxes, or family-friendly schools, you need real numbers-not vague advice.

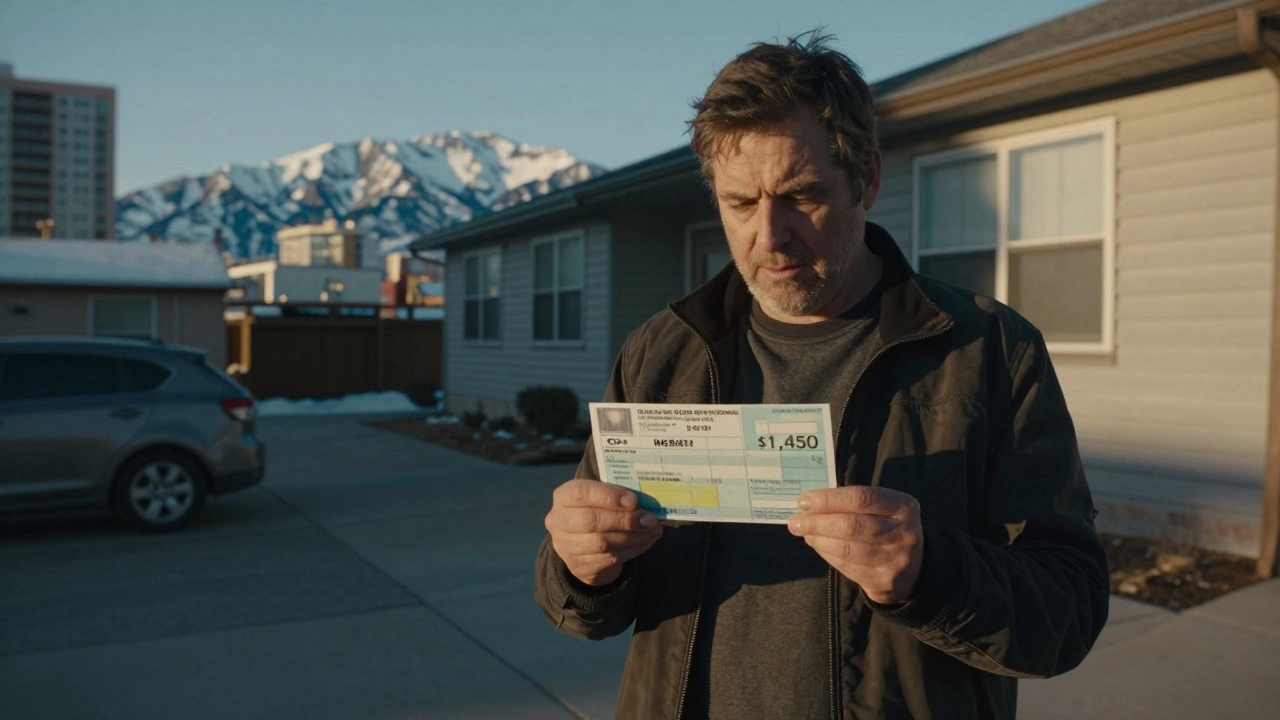

What’s the Real Cost of Rent in Utah?

Rent is the biggest chunk of your monthly budget. In Salt Lake City, a one-bedroom apartment in a decent neighborhood averages $1,450. A two-bedroom? Around $1,850. That’s up 18% since 2022. In Provo, where Brigham Young University drives demand, you’ll pay $1,300 for a one-bedroom and $1,650 for two. But head to Ogden or St. George, and you can find one-bedrooms for $1,100-$1,250. Rural areas like Price or Moab? You might find something for $900, but you’ll trade convenience for savings.

And don’t forget utilities. Electricity and gas aren’t cheap here. Average monthly utility costs (including heating in winter) run $150-$200. Water and trash add another $50. That’s $200-$250 just to keep the lights on and the pipes working.

Food, Gas, and Daily Expenses

Groceries in Utah are about 5% cheaper than the national average. A family of four spends roughly $800-$1,000 a month on food. A single person? Around $350-$450. That’s doable-but not if you’re buying organic or eating out often.

Gas prices? They hover around $3.40-$3.70 a gallon. Utah’s a big state. If you commute 30 miles each way to work, you’re burning $150-$200 a month on fuel alone. Public transit? It exists in Salt Lake City, but it’s limited. Outside the Wasatch Front, you need a car. And cars cost more to insure here than in most states-average annual premium is $1,550.

Taxes: The Utah Advantage

Utah has one of the lowest state income tax rates in the country: 4.85%. No local income tax. No estate tax. No inheritance tax. That’s a big deal. If you make $60,000 a year, you’ll pay about $2,900 in state income tax. In California, that same salary could cost you $4,500+ in state taxes alone.

Property taxes are also low-average effective rate is 0.58%. That means a $350,000 home costs around $2,000 a year in property taxes. Compare that to New Jersey, where the same home could cost $8,000+. Utah’s tax system keeps more money in your pocket.

Childcare and Education

If you have kids, childcare is a hidden cost. Full-time daycare in Salt Lake City runs $900-$1,200 a month per child. Preschool? $600-$800. That’s $1,800-$2,400 a month for two kids. That’s more than your rent in some places.

Public schools are decent and mostly free. Utah spends about $8,500 per student annually-slightly below the national average. But if you want private school, expect $10,000-$18,000 per year. That’s not optional for some families-it’s a budget-breaker.

Healthcare and Insurance

Health insurance premiums in Utah are about 8% lower than the national average. A single person’s monthly premium for a mid-tier plan is around $380. Family plans? About $1,100. That’s still a lot, but better than Arizona or Colorado.

Out-of-pocket costs? Deductibles average $4,000 for individuals and $8,000 for families. If you need surgery or chronic care, you’ll feel it. Emergency room visits cost $1,200-$2,500 without insurance. Utah has good hospitals, but they’re not cheap.

Putting It All Together: The Real Salary Numbers

Let’s break this down for a single adult living alone:

- Rent (one-bedroom): $1,400

- Utilities: $180

- Food: $400

- Gas + car insurance: $300

- Health insurance: $380

- Phone + internet: $100

- Entertainment, clothing, personal care: $250

- Savings buffer (recommended): $300

Total monthly: $3,310

That’s $39,720 a year before taxes. After Utah’s 4.85% income tax, you’d need to earn $41,700 to live comfortably-no extras, no emergencies, no splurges.

For a family of four (two adults, two kids):

- Rent (two-bedroom): $1,800

- Utilities: $200

- Food: $950

- Gas + insurance: $350

- Health insurance (family plan): $1,100

- Childcare (two kids): $2,200

- Phone + internet: $100

- Personal expenses: $400

- Savings buffer: $500

Total monthly: $7,600

Annual pre-tax salary needed: $91,200. After taxes: $95,500.

Can You Live on Minimum Wage in Utah?

Utah’s minimum wage is $8.65/hour. Full-time, that’s $18,000 a year. You can’t survive on that unless you’re sharing housing with three roommates, eating food stamps, and skipping healthcare. Even with Section 8 housing assistance, you’d still need a second job.

Most entry-level jobs in Utah pay $15-$18/hour. That’s $31,200-$37,440 annually. It’s possible to get by-but you’ll be one flat tire or medical bill away from crisis.

Where Can You Live Comfortably on K?

If you make $50,000 a year, you’re not rich-but you’re not broke either. You can live in Ogden, Logan, or even parts of Salt Lake City if you’re smart.

- Choose a one-bedroom apartment outside downtown

- Drive a used car, keep insurance low

- Shop at Walmart, Costco, or local farmers markets

- Use free community events for entertainment

- Work from home if you can to save on gas

It’s tight, but doable. You won’t be saving much, but you’ll have a roof, food, and access to mountains and trails.

What About Buying Land or a House?

If you’re thinking about buying land in Utah, you need to know this: raw land in rural areas can cost $5,000-$20,000 per acre. But building on it? That’s where it gets expensive. Permits, septic systems, well drilling, and road access can add $50,000-$150,000 before you even lay a foundation.

A 2,000-square-foot home in a growing area like Spanish Fork or Herriman costs $400,000-$500,000. With a 20% down payment, your mortgage is $320,000. At 6.5% interest, your monthly payment is $2,020-not including taxes, insurance, or maintenance.

That means you need to earn at least $85,000-$90,000 to buy a home without stretching too thin. And you need good credit. Utah lenders are strict.

Final Answer: What Salary Do You Actually Need?

Here’s the straight answer:

- Single adult: $42,000/year minimum to live without stress

- Single parent: $65,000-$75,000/year

- Family of four: $95,000-$110,000/year

- Homebuyer: $85,000+ to buy a modest home

Utah is affordable compared to California or Colorado-but it’s not cheap. Wages are rising, but so are rents, childcare, and healthcare. The state’s low taxes help, but they don’t erase the cost of living.

If you’re moving here for the lifestyle, make sure your salary can handle the reality-not just the Instagram version. The mountains are free. The rent isn’t.

What is the minimum salary needed to live in Utah?

A single adult needs at least $42,000 a year before taxes to cover rent, utilities, food, transportation, insurance, and basic savings. Anything less forces you to rely on roommates, food assistance, or multiple jobs.

Is $60,000 a good salary in Utah?

Yes, $60,000 is a solid salary for a single person or a couple without kids. You can live comfortably in Ogden, Provo, or outside Salt Lake City’s most expensive neighborhoods. But if you have children, especially needing daycare, you’ll be stretched thin.

How much do you need to buy a house in Utah?

To buy a median-priced home ($450,000), you need to earn at least $85,000-$90,000 annually. Lenders require a debt-to-income ratio under 43%, and Utah’s high housing costs mean your mortgage payment alone could be $2,000+ per month.

Are property taxes high in Utah?

No. Utah has one of the lowest effective property tax rates in the U.S.-just 0.58%. For a $400,000 home, you’ll pay around $2,300 per year. That’s far less than states like New Jersey or Illinois.

Is Utah cheaper than Colorado?

Yes, generally. Utah’s cost of living is about 12% lower than Colorado’s. Rent, groceries, and healthcare are cheaper. But housing prices in places like Park City or Salt Lake City are catching up. Still, for most people, Utah offers more value for the dollar.

Can you live in Utah without a car?

Only in Salt Lake City’s core neighborhoods like Downtown, Sugar House, or the University area. Outside those zones, public transit is sparse. In most cities and towns, you need a car to get to work, grocery stores, or even the park. Biking is possible in summer, but winters make it impractical.

What’s the best city in Utah to live on a modest income?

Ogden is the best bet. It has lower rent than Salt Lake City, decent job opportunities, and access to outdoor recreation. Logan and Price are also affordable. Avoid Park City, Deer Valley, or the Wasatch Back if you’re on a tight budget.