Virginia Housing Grant Eligibility Calculator

Check Your Eligibility

This tool helps determine if you qualify for the Virginia Housing grant based on income limits, home price caps, and other requirements.

If you're looking to buy your first home in Virginia and don't have a lot of money saved up, the Virginia Housing grant might be your best shot at getting into the market. But not everyone qualifies. The program isn’t open to just anyone-it’s designed for specific groups of people who meet clear income, credit, and residency rules. If you’re wondering whether you’re eligible, here’s exactly what you need to know-no fluff, no jargon, just the facts.

Who Can Apply for the Virginia Housing Grant?

The Virginia Housing Development Authority (VHDA) offers several grant programs, but the most common one for homebuyers is the Homeownership Down Payment and Closing Cost Grant. This grant gives you up to $10,000 toward your down payment or closing costs when you buy a home in Virginia. It’s not a loan-you don’t pay it back.

To qualify, you must be a first-time homebuyer. That means you haven’t owned a home in the last three years. There are exceptions if you’re buying in a targeted area like a federally designated Opportunity Zone, or if you’re a veteran or active-duty military member. Even if you owned a home before, you might still qualify under those special cases.

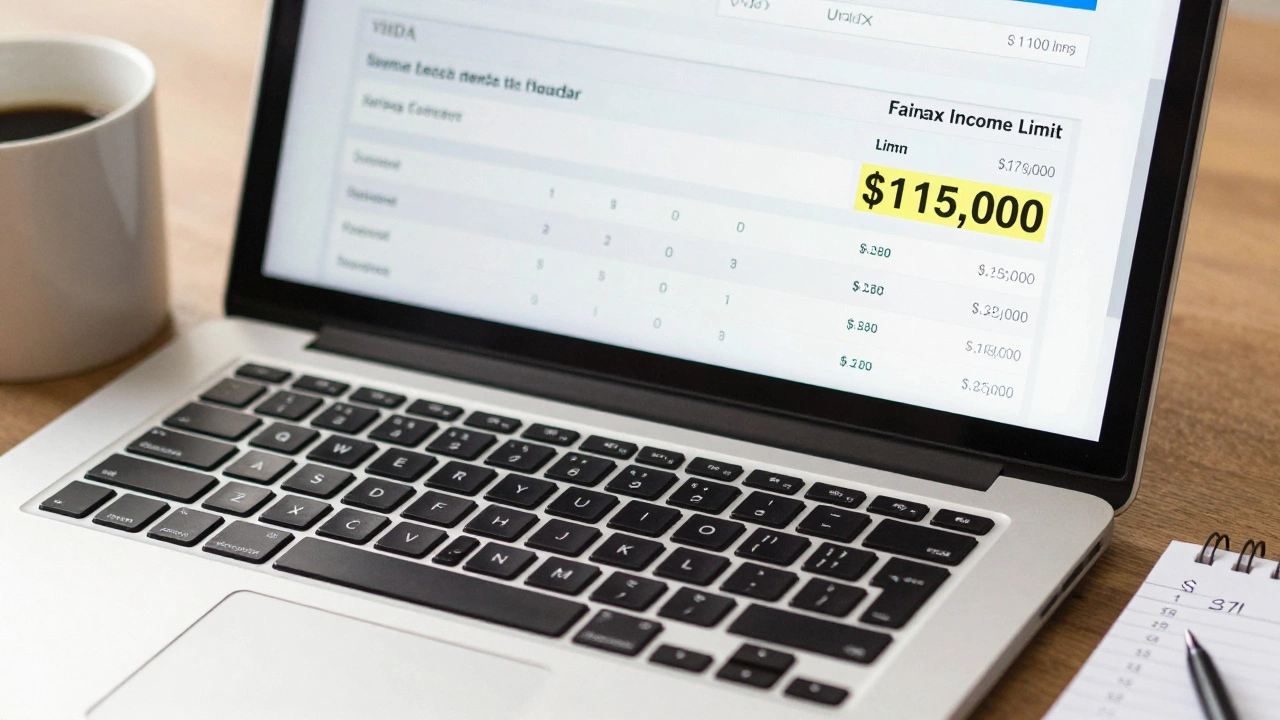

Income Limits Matter-Here’s What You Can Earn

Income is the biggest gatekeeper. VHDA sets income limits based on where you want to buy and how many people are in your household. These limits are updated every year, and as of 2026, they range from $75,000 to $135,000 depending on the county.

For example:

- In Fairfax County, a single person can earn up to $115,000 and still qualify.

- In Roanoke, the limit for a family of four is $128,000.

- In rural counties like Buchanan or Lee, the cap goes as high as $135,000 for larger households.

You can find the exact income limit for your county on the VHDA website, but here’s the rule of thumb: if your gross annual income (before taxes) is under $135,000, you’re likely in the running. The program is meant for middle-income families-not the very poor, not the very rich.

Home Price Caps Are Strict

The house you buy can’t cost more than the maximum allowed price in your area. These limits are tied to the median home price in your county and are adjusted annually. In 2026, the maximum home price for most areas ranges from $425,000 to $575,000.

For instance:

- In Richmond, the cap is $515,000.

- In Norfolk, it’s $500,000.

- In Charlottesville, it’s $575,000.

- In smaller towns like Danville or Harrisonburg, the cap is around $450,000.

If you find a home that’s $10,000 over the limit, you’re out of luck-even if you have the cash to cover the difference. The grant only works with homes that meet the price ceiling.

Credit Score Requirements Are Surprisingly Low

Many people assume you need a 700+ credit score to buy a home with help. Not with Virginia Housing. The minimum credit score needed is 640 for most programs. If you’re using a VA or FHA loan, you might even qualify with a score as low as 620.

What matters more than your score is your debt-to-income ratio. Your monthly debts-including car payments, student loans, and credit card minimums-can’t add up to more than 45% of your gross monthly income. So if you make $5,000 a month, your total monthly debt payments must be under $2,250.

You Must Take a Homebuyer Education Course

Before you can get the grant, you’re required to complete a state-approved homebuyer education course. These courses are usually 6 to 8 hours long and cover budgeting, mortgage basics, home inspections, and maintaining your home. Many are free or cost less than $50.

You can take the course online through VHDA’s partner providers like NeighborWorks or local housing counselors. Once you finish, you’ll get a certificate. You need to submit that certificate with your grant application. No certificate, no grant.

Property Type Restrictions

You can’t use the grant to buy a vacation home, rental property, or commercial building. The home must be your primary residence. You have to live there full-time.

Eligible property types include:

- Single-family homes

- Condos

- Townhomes

- Manufactured homes (if they’re permanently affixed to a foundation and meet HUD standards)

Mobile homes on wheels, duplexes where you don’t live in one unit, and multi-family homes with more than four units are not allowed.

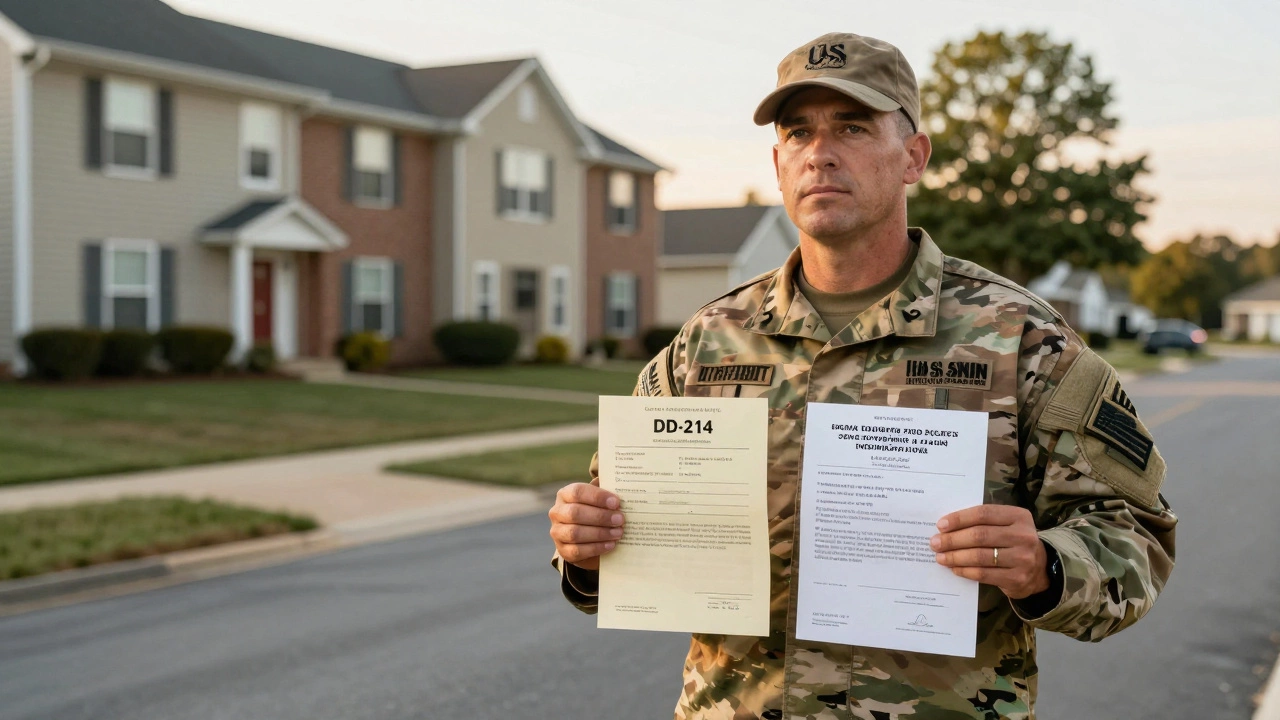

Are You a Veteran or Military Member?

Virginia Housing gives special treatment to veterans, active-duty service members, and surviving spouses. You don’t need to be a first-time buyer to qualify if you’re in this group. The income limits are higher, and you can use the grant even if you’ve owned a home before.

You also get access to the Virginia Military Homeownership Program, which offers lower interest rates and additional down payment help. If you have a DD-214 or other proof of service, make sure to mention it when you apply.

How to Apply

You can’t apply directly to VHDA. You must work with a VHDA-approved lender. These are local banks, credit unions, or mortgage brokers who know how to submit the paperwork correctly.

Here’s the step-by-step:

- Find a VHDA-approved lender. You can search the list on the VHDA website.

- Get pre-approved for a mortgage. Make sure they know you want to use the Virginia Housing grant.

- Complete the homebuyer education course and get your certificate.

- Find a home under the price limit in your county.

- Submit your application through your lender. They’ll handle the grant paperwork.

- Close on your home. The grant money goes directly to closing costs or your down payment.

The whole process usually takes 30 to 60 days from start to finish. Don’t wait until the last minute-start the homebuyer course early. Lenders get busy in spring, and the grant funds are limited each year.

What If You Don’t Qualify?

Not everyone fits the mold. If your income is too high, your credit score too low, or you’re buying a home that’s too expensive, you might still have options.

- Look into local city or county programs. Cities like Alexandria, Norfolk, and Roanoke offer their own grants with different rules.

- Check if you qualify for FHA, VA, or USDA loans-they have lower down payments and more flexible income rules.

- Consider buying in a lower-cost area. Moving from Arlington to Clarke County could make you eligible overnight.

Don’t give up if you’re turned down. Many people get approved on their second try after improving their credit or saving a little more.

Common Mistakes to Avoid

Here are the top three reasons people get denied:

- They think they’re a first-time buyer but owned a home two years ago. The three-year rule is strict.

- They pick a home that’s $20,000 over the price cap and assume they can pay the difference. They can’t.

- They skip the homebuyer course and try to apply anyway. The certificate is mandatory.

Also, don’t assume your lender knows about the grant. Many general lenders don’t handle VHDA programs. Always confirm your lender is approved before you start.

Final Thoughts

The Virginia Housing grant isn’t a handout. It’s a tool for people who are ready to buy but can’t afford the upfront costs. It doesn’t require perfect credit, and it doesn’t ask for a huge down payment. But it does require you to be organized, honest about your income, and willing to complete the training.

If you’re within the income limits, buying in the right area, and ready to take the course, this grant could cut your out-of-pocket costs by $5,000 to $10,000. That’s enough to cover closing costs, new appliances, or even a year of property taxes. It’s not magic-but it’s real, and it works for thousands of Virginians every year.

Do I have to be a U.S. citizen to qualify for the Virginia Housing grant?

No, you don’t need to be a U.S. citizen, but you must be a lawful permanent resident or have eligible non-citizen status as defined by HUD. You’ll need to provide documentation like a Permanent Resident Card (Green Card) or Employment Authorization Document. The grant is not available to those on temporary visas like H-1B or F-1.

Can I use the grant with a 30-year fixed mortgage?

Yes, the Virginia Housing grant works with 30-year fixed-rate mortgages, which are the most common. It also works with 15-year fixed loans and FHA or VA loans. Adjustable-rate mortgages (ARMs) are not allowed.

Is there a limit on how many times I can use the grant?

You can only use the grant once. It’s designed for first-time homebuyers. Even if you sell the home later and move, you can’t get the grant again unless you qualify under a special exception like being a veteran who previously owned a home.

What if my income goes up after I get the grant?

Your income at the time of application is what matters. Once you close on the home, your future earnings don’t affect the grant. You won’t have to pay it back if you get a raise, switch jobs, or your spouse starts earning more.

Can I use the grant to buy a home with a co-buyer who doesn’t qualify?

Yes, as long as at least one buyer meets all the eligibility requirements-including being a first-time buyer and falling under the income limit. The qualifying buyer must be on the mortgage and the grant application. The non-qualifying buyer can be on the title but can’t be the one applying for the grant.