Equity Made Simple for Homeowners and Investors

When you hear the word "equity" you might picture stock markets or financial jargon, but in real estate it’s a lot more down‑to‑earth. It’s the part of your property that actually belongs to you after you subtract any loans. Knowing how equity works can help you decide when to refinance, when to sell, or how to fund a new investment. Below you’ll find quick guides, real‑world examples, and easy steps to put your equity to work.

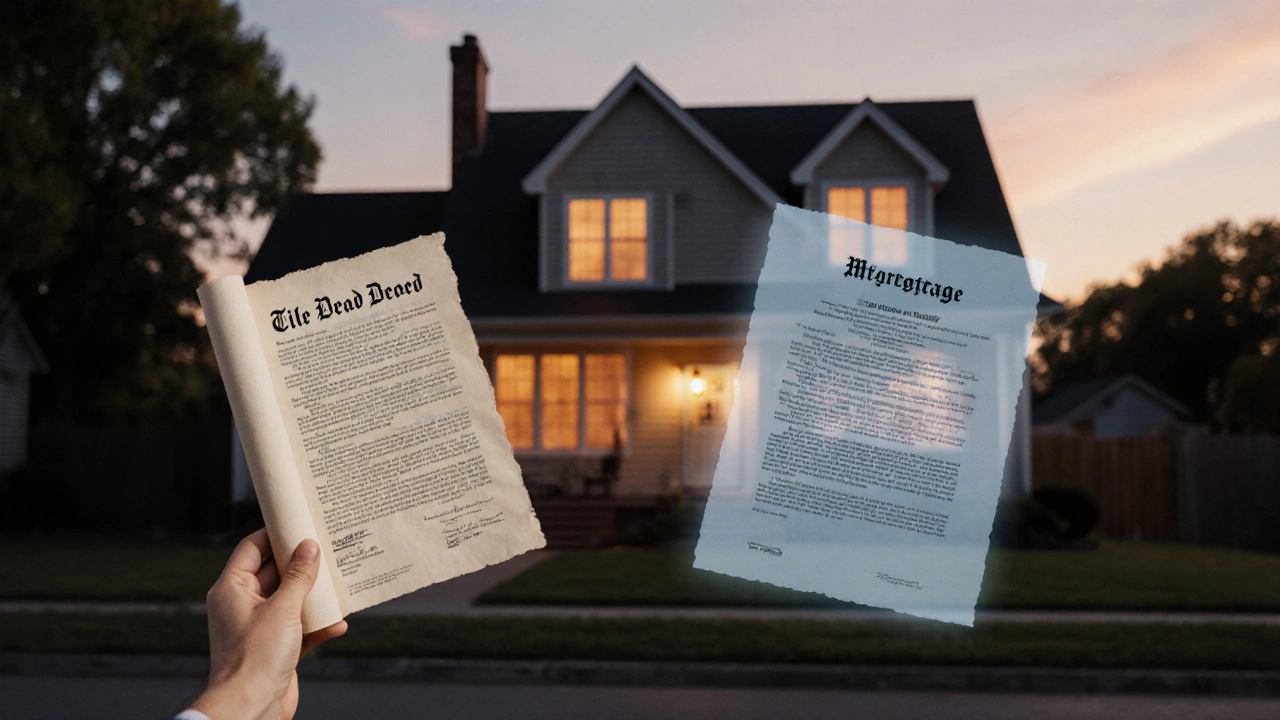

What Is Equity and How Is It Calculated?

Equity is simply the market value of your home minus any outstanding mortgage balance. For example, if your house is worth $300,000 and you still owe $180,000, your equity is $120,000. That number isn’t static – it grows when your property value climbs or when you pay down the loan, and it can shrink if the market drops or you take extra debt against the house.

Most owners build equity slowly, month after month, as they make mortgage payments. Some boost it faster by doing upgrades that raise the home’s resale value. Think of a kitchen remodel that adds $15,000 to the sale price – that extra value becomes part of your equity, too.

Using Equity to Grow Your Real Estate Portfolio

Once you have a solid equity base, you have a toolbox of options. One common move is a cash‑out refinance: you replace your existing mortgage with a larger one and keep the difference as cash. That cash can fund a down‑payment on a rental property, cover home‑improvement costs, or pay off high‑interest debt.

Another route is a home‑equity line of credit (HELOC). It works like a credit card tied to your house value. You draw only what you need, pay interest only on that amount, and repay as you go. HELOCs are great for short‑term projects, like a bathroom upgrade, because they keep your monthly costs low.

If you’re ready to invest, consider using equity as a down‑payment on a second property. Lenders often accept a lower down‑payment if you can show strong equity in your primary home. This lets you start earning rental income while still keeping your first house.

Remember, any move that uses equity adds risk. Borrowing against your home means you could lose it if you can’t keep up with payments. Always run the numbers, think about cash flow, and make sure you have a safety net.

Bottom line: equity is the invisible asset that can power your next real‑estate move. Track it, protect it, and use it wisely to turn a home you live in today into the foundation for future wealth.

Homeowner or Borrower? How a Mortgage Affects Your Property Ownership

by Arjun Mehta Oct 20 2025 0 Property RegistrationExplore whether a mortgage affects your homeowner status, understand rights, registration steps, and key misconceptions in clear, practical terms.

READ MOREHow to Get Equity Out of Commercial Property Fast

by Arjun Mehta May 3 2025 0 Commercial PropertyIf you've been wondering how to get cash or value out of your commercial property, you're not alone. This article breaks down the main ways to tap into your equity, step-by-step, without the jargon. We'll look at what equity really means, the pros and cons of popular methods like refinancing and selling, and share tips most owners miss. Find out how real owners use equity as leverage for new opportunities. You'll walk away knowing the smartest moves for your own situation.

READ MORE