New York City Land Ownership: What You Need to Know

When dealing with New York City land ownership, the legal rights and responsibilities tied to owning a parcel of land within the five boroughs of NYC. Also known as NYC property rights, it shapes how you buy, sell, lease, and even improve a piece of land. New York City land ownership involves a land title, a record that proves who holds the ultimate right to the land and a deed, the document that transfers that title from one party to another.

These two pieces—title and deed—are meaningless without the city's registration system. The NYC land registry, run by the Department of Finance, records every title change and ties it to a unique account number. This registration step is required for any sale, mortgage, or tax assessment to be valid. It also means that once a deed is filed, the new owner gains the ability to enforce their rights in court, collect rent, or develop the property, provided they follow local rules.

Key Factors That Shape NYC Land Ownership

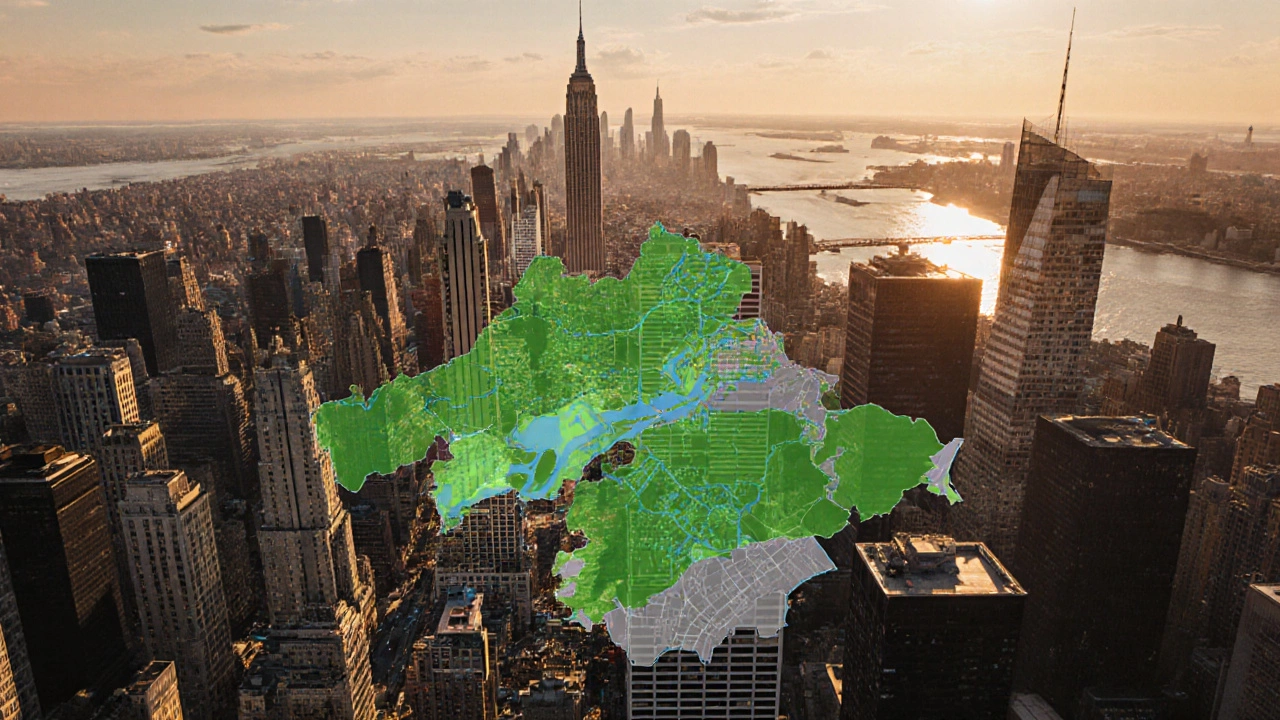

One of the biggest influences on what you can do with land in the city is NYC zoning, a set of regulations that dictate allowed uses, building heights, density, and setbacks. Zoning acts like a roadmap: it tells you whether a parcel can host a residential tower, a mixed‑use development, or stay as a single‑family home. Ignoring zoning can halt a project in its tracks, lead to costly redesigns, or even result in fines. In practice, zoning interacts directly with land title: a clean title lets you apply for zoning variances, while zoning limits define how valuable that title becomes in the market.

The financial side of ownership is equally important. Property tax in NYC is calculated on the assessed value of the land and any improvements on it. The tax bill is sent by the Department of Finance each year, and it can vary significantly between boroughs and even between neighboring blocks. Understanding your tax liability early helps you budget for holding costs and can affect financing terms. Many buyers factor tax rates into their offer price because high taxes can erode cash flow from rental properties.

Another practical consideration is the difference between owning land outright and holding it through a corporation or LLC. Corporate ownership can provide liability protection and tax benefits, but it also adds layers of paperwork, annual filing fees, and potential complications when you want to sell. If you intend to develop the land yourself, a personal title might simplify permits and financing. However, for investors who plan to rent out multiple units, an LLC often makes sense to keep personal assets separate.

Land ownership in NYC also brings a set of tenant‑related responsibilities. Once a building is occupied, landlord‑tenant law kicks in, governing everything from lease termination to rent stabilization. Even if you own a vacant lot, you must comply with city ordinances about maintaining the site—like keeping it clean, fenced, and free of hazards. Failure to meet these standards can result in violations, fines, or even a city‑ordered cleanup.

Because the market moves fast, keeping track of recent sales, pending developments, and upcoming zoning changes is vital. Tools like the NYC Open Data portal, property tax maps, and real‑time MLS listings give you a snapshot of what’s happening on the ground. Many investors subscribe to newsletters that highlight newly listed parcels or shifts in zoning districts, allowing them to act before competitors.

If you’re a first‑time buyer, the process can feel overwhelming, but breaking it down helps. Start with a title search to confirm ownership history and any liens. Next, review the zoning map to ensure your intended use is permitted. Then, estimate property tax based on the latest assessment. Finally, evaluate financing options—most banks require a clear title and will look closely at the property's zoning classification when determining loan terms.

For seasoned owners, the focus shifts to maximizing the land’s value. This could mean filing for a zoning variance to increase allowable floor area, conducting a tax abatement study to reduce annual costs, or partnering with a developer to leverage the land’s location. Each strategy hinges on a solid understanding of the legal framework that defines New York City land ownership.

Below you’ll find a curated list of articles that dig deeper into each of these topics—commercial property valuation, mortgage impacts, rental regulations, and more. Whether you’re just starting out or looking to refine an existing portfolio, the resources ahead will give you actionable insights tailored to the unique landscape of NYC land ownership.

Who Is the Largest Landowner in NYC? 2025 Revealed

by Arjun Mehta Oct 25 2025 0 Property RegistrationDiscover who holds the most land in New York City, how the city tops the list, and how to verify ownership using NYC property records.

READ MORE