Tenant Fees Explained: What You Really Pay When Renting

When you sign a lease, tenant fees, charges renters pay upfront beyond first month’s rent. Also known as rental fees, these are often misunderstood—and sometimes illegally added. Not all fees are legal. Some landlords charge for everything from cleaning to pet screening, but in many places, only a security deposit and a background check fee are allowed. Knowing the difference can save you hundreds—or even thousands—before you even move in.

Common security deposits, money held by the landlord to cover damage or unpaid rent usually match one month’s rent, but some states cap them at 1.5x or 2x. Then there’s the rental application fee, a non-refundable charge to process your background and credit check. In some states, this can’t exceed the actual cost of running the check. But in others, landlords inflate it to $75 or more. And don’t get fooled by "pet fees" or "cleaning fees"—if they’re not clearly tied to actual services or legally allowed, they’re just profit grabs.

What about move-in costs? Some landlords charge for key replacements, lock changes, or even "administrative fees." These aren’t standard. If you’re in India, rules vary by state, but the tenant fees you pay should always be written into the lease. Verbal promises don’t count. And if a landlord says "it’s industry standard," ask for the law. Most renters never check, and that’s how overcharges stick.

Look at the posts below. You’ll find real examples: how landlords in Virginia mislead on square footage to justify higher rent, what salary you need to afford rent in Utah or Austin, and how commercial property investors calculate returns—because rental income is part of the same system. Some posts show how to spot fake listings, others break down what’s legal in Maryland or Virginia. This isn’t about theory. It’s about what’s actually in your lease, what’s on your bank statement, and what you can fight back against.

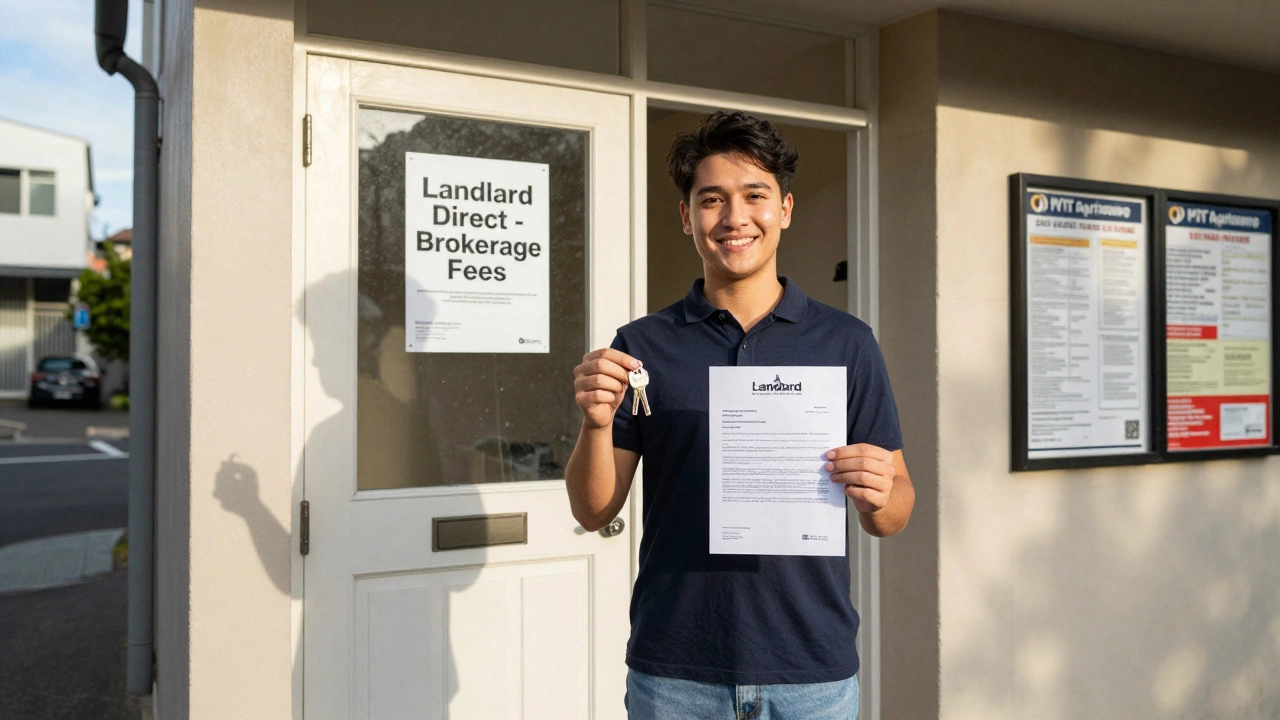

What Is a Brokerage for Rent? Understanding Fees and How to Avoid Them

by Arjun Mehta Dec 1 2025 0 RentalsA brokerage for rent is an illegal fee some agents charge tenants in Melbourne. Learn what fees are actually allowed, how to find rent without brokerage, and how to get your money back if you’ve been overcharged.

READ MORE