Homeowner Guides and Insights

When talking about Homeowner, someone who owns and lives in a residential property. Also known as property owner, this role blends personal living needs with financial responsibilities. A commercial property, a building or land used for business activities owner often faces similar decisions, but the stakes shift when income‑producing spaces enter the picture. Understanding how homeowner duties intersect with market trends is key: property ownership encompasses budgeting, maintenance, and long‑term planning, while also requiring knowledge of tax rules and valuation methods. For many, the first step is figuring out how much their home is really worth, then using that figure to guide refinancing, selling, or upgrading decisions.

Key Financial Aspects Every Owner Should Master

One of the biggest puzzles for a homeowner is rental income, money earned from leasing a property to tenants. Even if you don’t rent out your primary residence, you might own a secondary unit or an investment property that generates cash flow. Knowing how to report that income, claim deductions, and stay compliant with local tax codes can make the difference between profit and loss. Speaking of taxes, property tax, the annual levy imposed by local governments based on assessed property value is another recurring cost that every homeowner must budget for. Rates vary widely across states and municipalities, so staying aware of your jurisdiction’s assessment schedule helps you avoid surprise bills. Equally important is the skill of property valuation, the process of estimating a property's market worth using data, comparables, and professional appraisal methods. Accurate valuation guides buying power, informs selling price, and determines how much equity you can tap for loans. It also influences how much property tax you’ll owe, creating a direct link between valuation and tax liabilities. For owners of commercial spaces, the stakes rise: valuation not only affects sale price but also impacts lease negotiations, financing terms, and even zoning considerations. By mastering these three financial pillars—rental income, property tax, and valuation—homeowners can make smarter, data‑driven decisions that protect and grow their wealth.

Beyond the numbers, homeowners often wonder about broader options like affordable housing programs, rent‑to‑own schemes, or the impact of recent zoning changes. While each of those topics deserves its own deep dive, the articles below give you a fast‑track overview of how they affect your ownership journey. From step‑by‑step guides on selling commercial property to checklists for managing rental units in Virginia, you’ll find practical tips that you can apply right away. Ready to explore the full collection? Scroll down to discover detailed advice, real‑world examples, and actionable strategies tailored for every type of property owner.

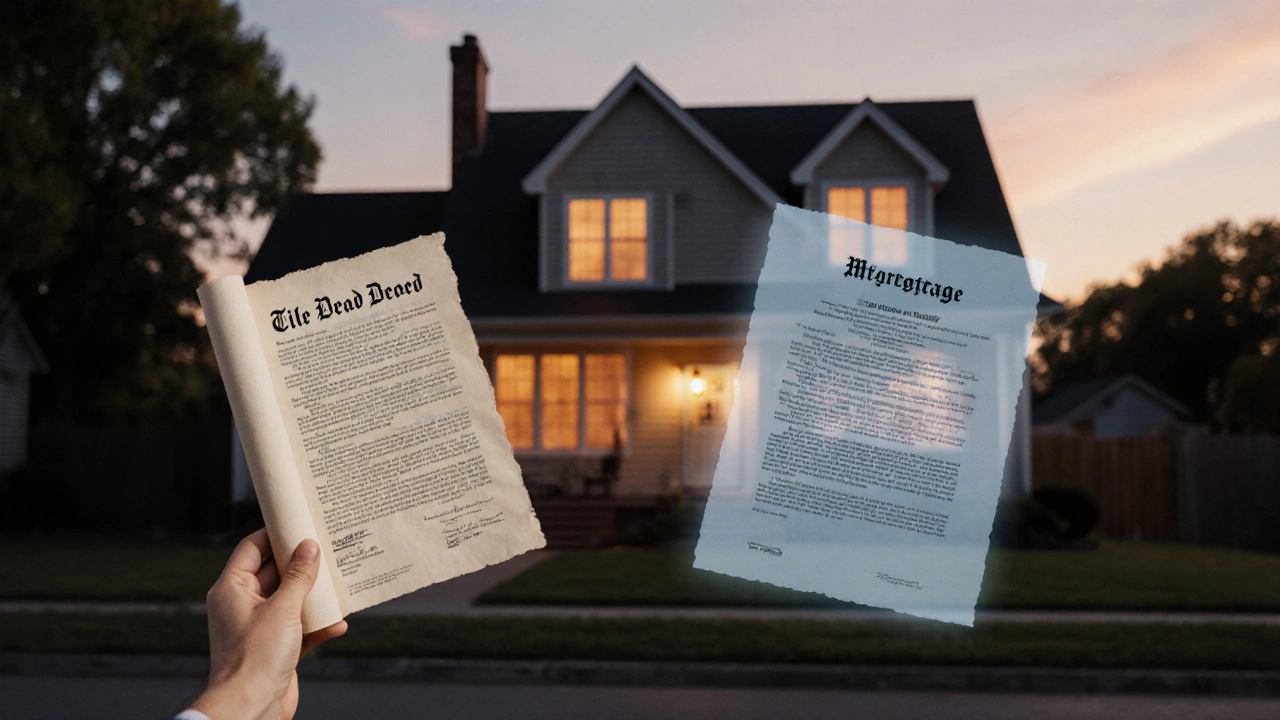

Homeowner or Borrower? How a Mortgage Affects Your Property Ownership

by Arjun Mehta Oct 20 2025 0 Property RegistrationExplore whether a mortgage affects your homeowner status, understand rights, registration steps, and key misconceptions in clear, practical terms.

READ MORE